The branch is dead, long live the branch! Controversy around the wisdom (or not) of investing in the branch channel amidst rapidly growing digital banking adoption is showing no signs of letting up. Consider three articles published in the past week:

- Bank Innovation covering Associated Bank branch closures to fund digital channel initiatives.

- BTN coverage of Wells Fargo branch/digital convergence alongside the banks’ steadfast advocacy for maintaining its massive branch presence.

- Brett King’s Op Ed in Banking Exchange, critical of the recent FDIC report, Brick-and-Mortar Banking Remains Prevalent in an Increasingly Virtual World

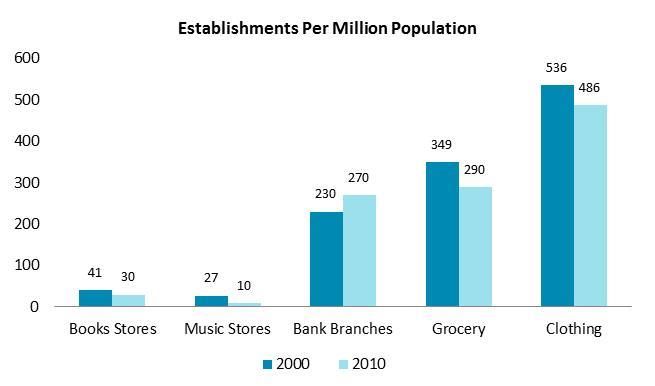

Source: US Department of Commerce, FDIC, Datamonitor, Celent analysis[/caption] Like retailers, banks have certainly embraced digital channels. But, unlike retailers, banks have not invested in digital engagement. Until recently, digital channels weren’t about sales and servicing (that’s what branches are for…) but about facilitating transactions. Rare is the retailer of any size that does not have a digital presence designed to conduct commerce. But, the significant majority of banks do not yet have that capability. And, in some cases, the user experience is poor. Why? In part, because banks have focused on transactions, not sales and service in the digital channels. As this changes (and it is), I believe we will see a corresponding contraction in branch densities – just like in most other retail segments. Until banks demonstrate the ability to sell and service customers digitally, they will be overly reliant on the branch channel. [caption id="attachment_4701" align="aligncenter" width="600"]

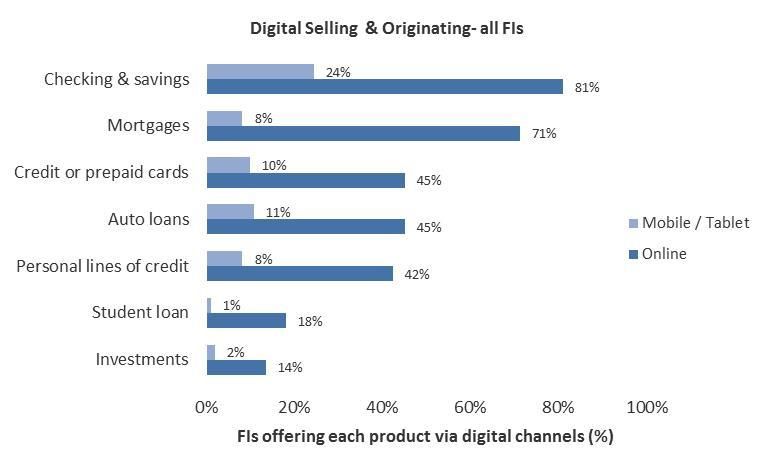

Source: US Department of Commerce, FDIC, Datamonitor, Celent analysis[/caption] Like retailers, banks have certainly embraced digital channels. But, unlike retailers, banks have not invested in digital engagement. Until recently, digital channels weren’t about sales and servicing (that’s what branches are for…) but about facilitating transactions. Rare is the retailer of any size that does not have a digital presence designed to conduct commerce. But, the significant majority of banks do not yet have that capability. And, in some cases, the user experience is poor. Why? In part, because banks have focused on transactions, not sales and service in the digital channels. As this changes (and it is), I believe we will see a corresponding contraction in branch densities – just like in most other retail segments. Until banks demonstrate the ability to sell and service customers digitally, they will be overly reliant on the branch channel. [caption id="attachment_4701" align="aligncenter" width="600"] Source: Celent survey of North American financial institutions, October 2014, n=156[/caption] The next few years will be telling. What do you think?

Source: Celent survey of North American financial institutions, October 2014, n=156[/caption] The next few years will be telling. What do you think?