APIs and their role in the evolution of the financial system are one of the hottest topics in banking today. How, though, are mainstream banks and credit unions approaching this technology? How important is it to them, how are they approaching governance, and what concrete steps have they taken? Celent explores what banks are actually doing about APIs today in our ninth Digital Banking Panel.

·Among other insights, Celent finds that bankers, particularly those representing smaller financial institutions, are generally unfamiliar with Open APIs. They are most familiar with the use of internal APIs to facilitate integration of disparate applications with core banking systems, but wholly unfamiliar with other use cases such as enabling innovation, banking as a platform, and customer connectivity/engagement. As a result, a minority of banks have concrete plans to fully leverage APIs.

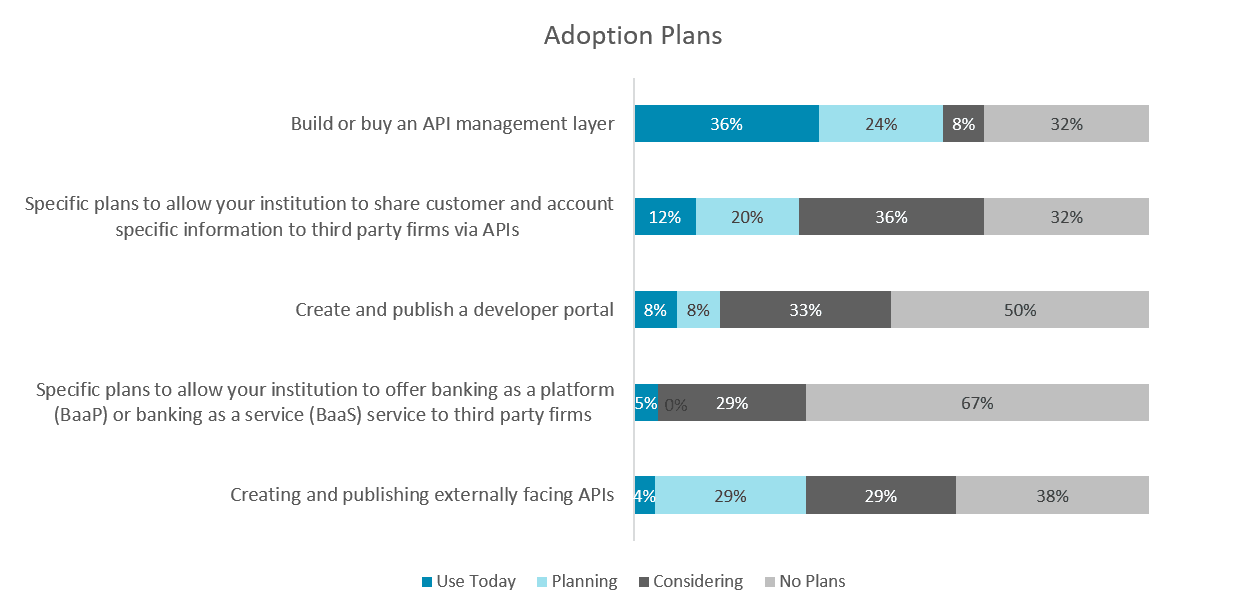

Source: Celent Digital Banking Panel, September 2019. Q: Indicate your institution’s plans, if any, around each of the following.