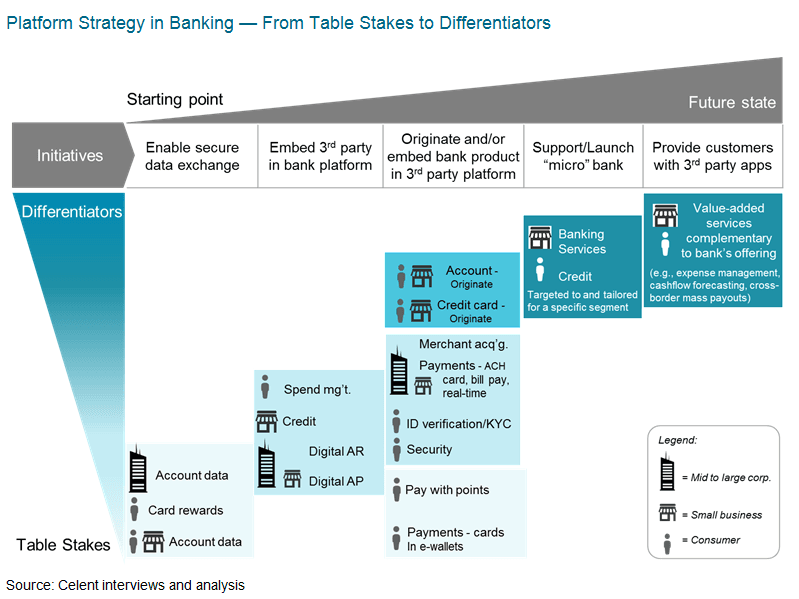

プラットフォームバンキングというビジネスモデルは、米国の銀行業界を劇的に変えるでしょう。銀行業の特性を鑑みると、銀行はAppleやFacebookのような大手IT企業のプラットフォーム戦略をそのまま踏襲するとは思えません。代わりに銀行は、銀行独自のハイブリッド戦略を構築するでしょう。

プラットフォームバンキングを進めるにあたり、米国の銀行の大半はまだ戦略構築やと実行フェーズの初期段階にいます。一部の先駆的な銀行は、安全なデータエクスチェンジに向けたオープンAPIをはじめ、限定的な取り組みを行っています。また一部の銀行は、自行のプラットフォームにサードパーティのサービスを接続し、自行商品やサービスの不足点を補ったり、商品ラインナップを強化したりしています。また少数ながら、サードパーティのプラットフォームを通じて独自の新商品を開発している銀行もいます。そして、さらに最先端をいく少数派は、特定の顧客層に特化したカスタマイズ商品を提供する「マイクロプラットフォーム」を支持しています。