The demand for applications is growing faster than the supply of developers to deliver them. A new era of low/no-code development is emerging not only to accelerate traditional development but to enable business users, or citizen developers, to contribute to application development, building tailored business workflow applications.

At its core, low/no code is fundamentally about abstraction and automation. Abstraction happens through prebuilt building blocks that allow users drag-and-drop capabilities that can be used for different use cases. Automation happens by creating and integrating the underlying code to assist in the design, build, test, deploy, and manage process.

Defining Low/No Code | A development methodology that leverages prebuilt building blocks, enabling developers and even business users to develop, integrate, and make changes to applications rapidly. |

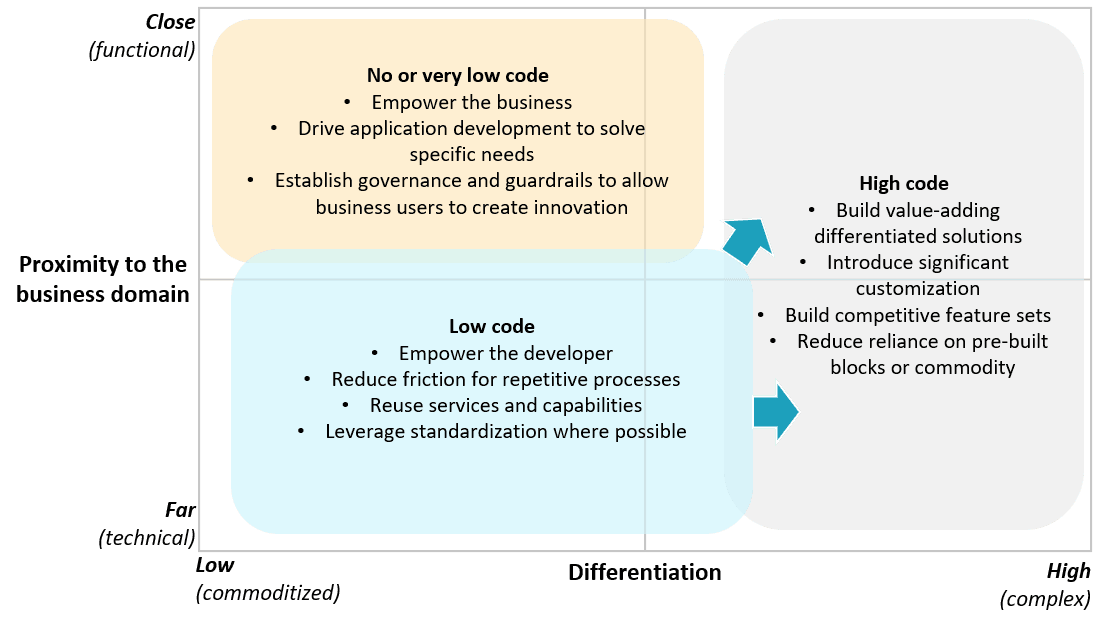

While low/no-code development has been around for a long time, advances in technology and platform maturity have made drag-and-drop development easier and more effective. In the appropriate place these platforms can be powerful accelerators, although financial institutions need to consider where and how to deploy these platforms. Celent focus on two primary questions: (1) how close to the business need is this application and (2) how differentiating is the application being built?

We expect the ecosystem around low/no code to boom in the coming years. For most banks, the advantages will be paramount to creating a competitive edge in the post-pandemic digital world. This report will address many of the pressing questions on the minds of our clients while outlining potential use cases, opportunities, pitfalls, and best practices.

For a deeper dive into the vendors enabling this trend please explore the companion report, Low/No Code Vendor in Banking: 2021 Spectrum Report, which will analyze providers and outline capabilities, customer base, strategic positioning, and more.

Vendors Mentioned: 3Forge, Appian, Caspio, FlowForma, Innoveo, Intellect, Mendix, ServiceNow, SS&C, Veritran, Vermeg, WaveMaker