AI is not an evolution, it's a revolution. And that is especially true for the wealth management industry where firms have been relying on legacy technology for far too long. AI and advanced data analytics are changing the ways financial advisors serve clients and wealth management firms operate.

On Tuesday, September 24th, I'll be speaking on a panel for Broadridge's webinar: Mastering Disruption: How AI and Data Are Redefining Wealth Management. Click the link to register. We'll be discussing:

- AI's role in revolutionizing wealth management

- The path to hyper-personalization

- Balancing technological innovation with data security

- Adapting to demographic shifts

In advance of the webinar, I wanted to share a few insights from Celent's research report, Dimensions: North American Wealth Management IT Pressures & Priorities 2024, that support that there is indeed a technological revolution underway—driven by data and AI—and show where it is happening. Celent surveyed 57 wealth management executives in North America with influence over technology buying decisions.

Insight #1

Half of wealth management executives in North America report that replacing or modernizing legacy/end-of-life systems and platforms is among their top drivers of technology spending strategy. This modernization—out with the old systems and in with the new—is a technological revolution.

Insight #2

The two most common technology priorities among executives are 1) data platforms and management and 2) artificial intelligence and advanced data analytics. It all starts with data: aggregation, management, integrations, and analytics.

Insight #3

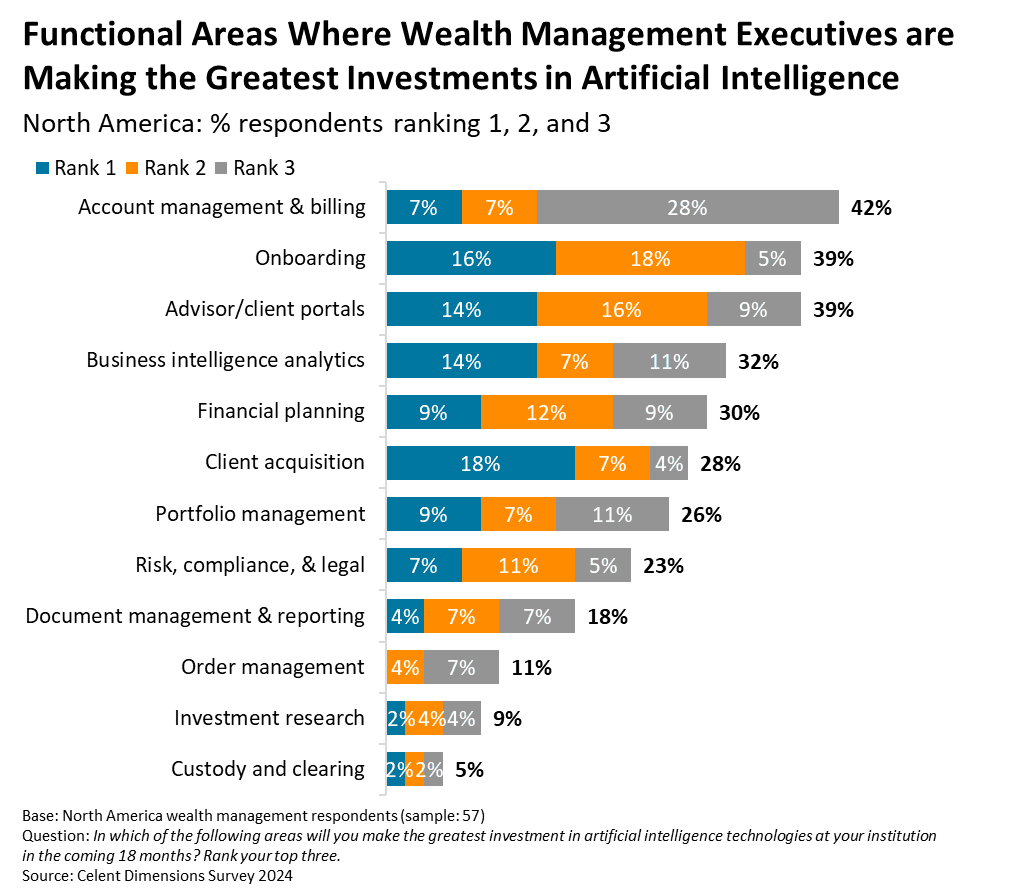

The most common areas seeing the greatest investments in AI in wealth management are 1) account management and billing, 2) onboarding, and 3) advisor/client portals. Client acquisition is the most common answer ranked number one for the greatest AI investments. During the webinar, I plan to dive deeper into how advisors are leveraging AI (and generative AI) to enhance the customer experience.

To hear a whole hour's worth of insights on how leading firms are leveraging AI and what the future of wealth management will look like, register for the Broadridge webinar here.