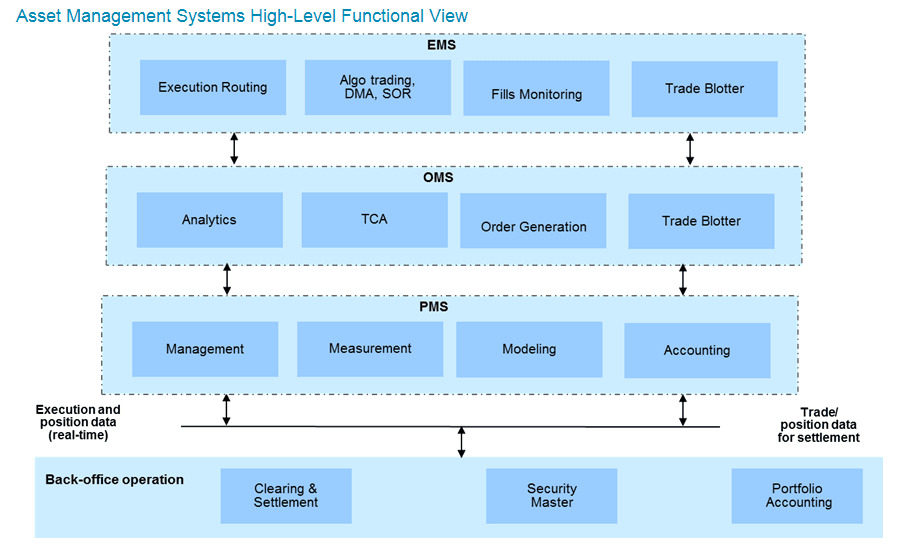

As asset managers continue to develop their trading desks, the interaction between the trading desk and portfolio managers is crucial. The aggregation of transactions and positions is the base layer, and buy side vendors continue to closely integrate order management systems (OMS) and portfolio management system (PMS) solutions to achieve this enterprise goal.

As asset managers continue to develop their trading desks, the interaction between the trading desk and portfolio managers is critical in achieving incremental precious basis points. Buy side traders are an important ingredient in maximizing portfolio return by minimizing execution costs and shortfall risk utilizing multiple go-to-market execution strategies and tactics.