Boston, MA, USA December 24, 2008

Business Process Outsourcing in North American Insurance

A new Celent report looks at the recent activity in business process outsourcing in the insurance sector in North America.

Recent economic events have brought cost containment to the top of the insurer agenda. The combination of unrelenting pressure on expenses, vast improvements in networking and communication technology, and an increased appreciation for highly flexible business models has caused virtually all insurance carriers to explore nontraditional options for running their businesses. Farming out core business processes to third parties...which was once unthinkable...is now considered a viable option. BPO providers quote 30% to 50% cost savings as well as significant process transformation benefits.

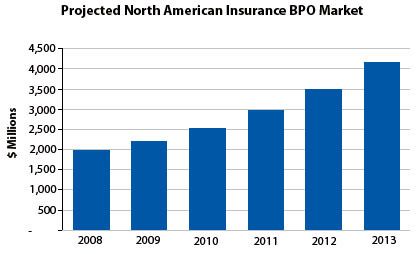

A new Celent report, Business Process Outsourcing in North American Insurance, provides a North American perspective on the insurance BPO sector. This report is designed to provide some context for discussion by establishing the current uses of BPO for core insurance services in a concrete way, based on input from the companies providing services to carriers. Twenty-six firms submitted information about current BPO deals, including lines of business covered, annual value of the deals, number of full-time equivalents (FTEs) represented, and specific business processes performed on each client’s behalf. The result is a current market sizing for core BPO insurance services, analysis of the state of the market, and a projection of what lies ahead.

"This report continues Celent’s BPO focus and updates previous research in this area," says Mike Fitzgerald

, senior analyst with Celent’s insurance practice and author of the report. "Our analysis only deals with core insurance BPO services such as underwriting, claims and distribution. This is a unique emphasis on only the most central activities of insurers."A companion report analyzing the European market is also available.

The report is 30 pages and contains 18 figures. A

table of contents is available online. of Celent's Property/Casualty Insurance and Life/Health Insurance research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.