Asia’s economic and banking landscape is far from homogeneous. The region has a diverse mix of small and large countries with widely varying levels of economic development, banking system maturity, and technology infrastructure. A common theme driving solution investment is enabling digital commerce across borders. The four primary drivers are:

- Development of real-time payment systems

- Cross-border linkage of new RTP payments systems

- Digital channels experiences

- Revitalization of trade services

Globally, corporate banking IT spending budgets increased on average from 2.6% in 2022 to 4.6% in 2023. After a sluggish 2022, Asia-Pacific shows significant year-over-year increases that bring the region close to the global average. However, the average for the region shows large variations across countries.

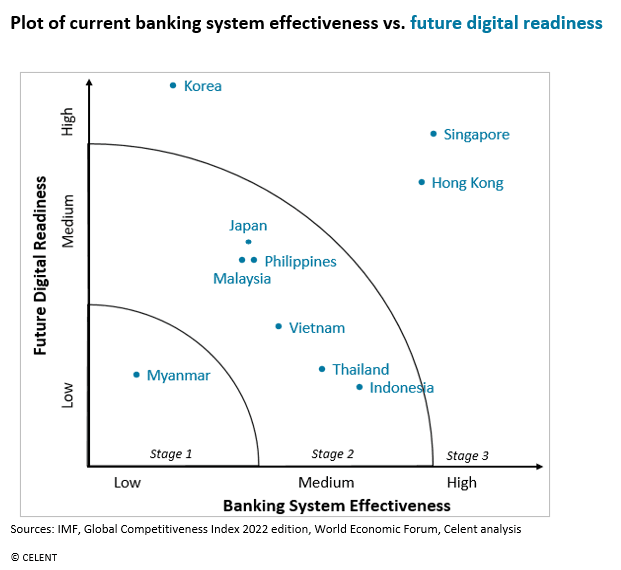

Banks and vendors looking to deliver digital banking to corporates operating in the Asia-Pacific region (especially the fast growing economies of Southeast Asia) must be aware of the underlying market trends, practices, capabilities, and competition. To help, Celent has developed a “radar map” that plots the maturity of the banking ecosystem against current technological infrastructure. A second version plots the maturity of the banking ecosystem against future digital readiness. This “radar” seeks to help identify which countries in the region are primed to enable economic growth through more modern corporate banking capabilities and experiences.