イニシャルマージン(IM)要件はグローバルな規制制度であり、OTCデリバティブ取引の取引先企業が支払不履行の場合に、損金を埋め合わせることによりシステムへの悪影響を限定することを目的としている。イニシャルマージンは市場参加者のリスク/担保物件管理業務、更にテクノロジーシステムに重要な影響をもたらす。

HIS Markit協賛の本レポートで、セレントはイニシャルマージン規制の背景を調査し、対象となる企業/状況および金融商品に関する要件の概要を提示している。更に、IM規制コンプライアンス達成のためにセルサイドとバイサイド両方の参加者が考慮すべき課題について考察し、テクノロジーの課題を検討し、サードパーティのソリューション/サービスおよびユーティリティを含む課題を克服するためのアプローチを提案している。本レポートは、イニシャルマージン・オペレーションへの移行およびそのメンテナンスを支援する企業のための提言で締めくくられている。

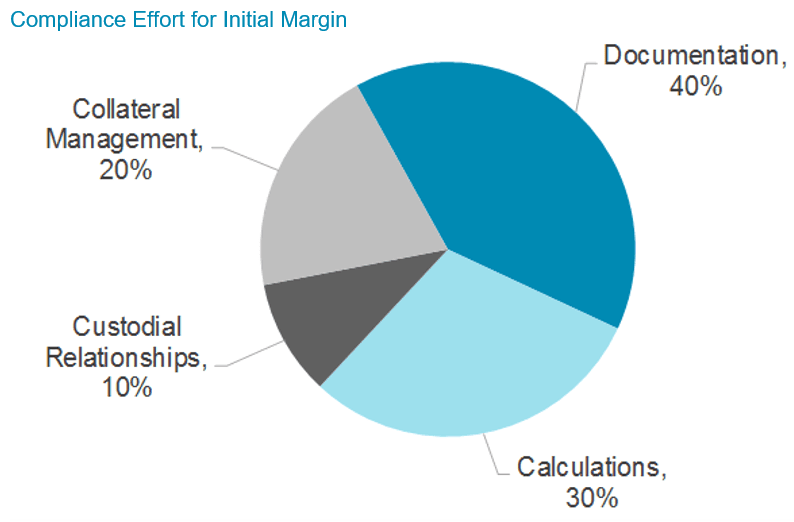

イニシャルマージン要件は、OTCデリバティブにおける未解決の想定リスクが一定量を超えているすべての市場参加者に適用されるグローバルな規制制度である。規制の下、対象となる企業がすべきことは以下の通り。

・イニシャルマージンのやりとりを管理する契約を取引先企業と結ぶ。

・イニシャルマージン要件を満たすために、双方の取引先企業が担保を記帳しておくための専用の保管口座を作る。

・承認されたモデルに従ってイニシャルマージンの金額を計算する。

・それらの金額を担保として専用保管口座に記帳する(および/または受領)する。

これらの要件は非常にわかりやすい一方で、イニシャルマージン・バリューチェーンのすべての輪は市場参加者の担保管理業務およびテクノロジーシステムに重要な影響をもたらす。更に、2018年はIM規制施行の中間点となったが、今後2年間で規制対象となる企業の数は10倍以上に増加する可能性がある。

要するに、IMは重大な局面を迎えている。

「イニシャルマージンは担保管理オペレーションの劇的な変化を象徴しており、企業はたびたびその課題は「測り知れない」と評している。2019年から2020年に対象となる中小企業の市場参加者は、大企業に求められてきたルールと同じルールを順守しようとする時、課題に直面するだろう。そのような中小企業の市場参加者は、専門知識、処理能力、予算の面で苦労を強いられるだろう。」

「金融業界の主導者は、イニシャルマージン規制によって企業にかかる負担を減らすための様々な緩和策を提唱してきた。一部の緩和策は認可される可能性があるが、IM導入成功のより確実な方法は、テクノロジーおよびプラットフォームのパートナーがサポートする自動化、STP、および文書のデジタル化である。」

(セレントリサーチ・ディレクター/本レポート執筆者 ニール・カタコフPhD)