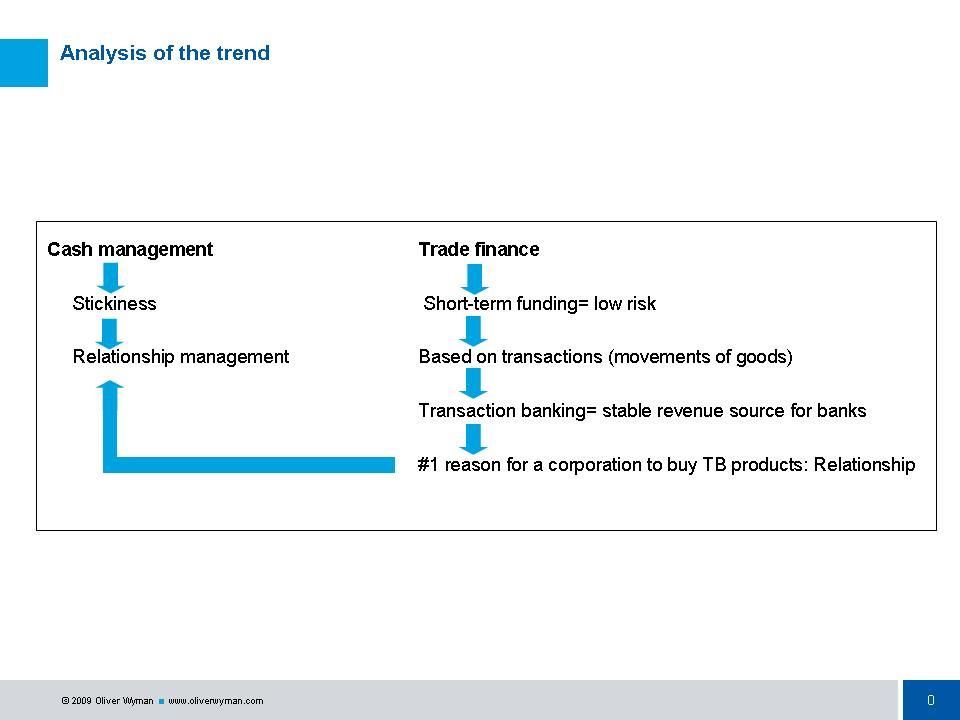

At Celent we are recording a constant trend among financial institutions to concentrate their cash management and trade finance offerings. This falls under the umbrella of Global Transaction Banking (GTB). That this interest is driven by a business imperative becomes immediately evident when we learn that, for instance, Deutsche Bank has experienced a 20% increase of its GTB market share in the last year. The need to build/ grow/ maintain the customer relationship is the main driver of this convergence, as identified by our factual analysis. From a bank’s strategic perspective, cash management services are offered to ensure customer “stickiness” (i.e., loyalty and retention). Market evidence shows that it costs 5 times as much to generate a new customer vs. maintaining an existing one. Therefore, customer stickiness is an imperative that can be secured through an appropriate relationship management. Cash management, therefore, is a strategic driver for a bank to properly govern its relationship management policy. Our analysis proves that also the provisioning of trade finance products and services leads to better manage the customer relationship strategy of a bank. Trade finance is typically considered a short-term funding exercise. Hence, it presents a very appealing low risk profile. Trade finance is purely based on transactions, since it is founded on the movement of physical goods, easily traceable and visible, especially with new technologies available (e.g. RFID- radio frequency IDentification). The financial value chain tied to transactions leads to transaction banking, a generally accepted stable revenue source for banks Market statistics show that the number one reason for a corporate to buy transaction banking services from a bank is intertwined with the level of relationship and confidence it has with that bank. And this, once again, closes the loop on the relationship management strategy of the bank. The process described is depicted in the figure below. Bottom line Cash management and trade finance are converging in the financial sector because they both support a bank’s customer relationship management strategy, a key competitive differentiator in the current business scenario.