More banks are entering the remote cash capture (RCC) market with the twin benefit of helping merchants reduce their cost of cash acceptance while reducing its incidence in retail branches. Lower-cost depository and recycling safes now entering the market can improve banks market opportunity and value proposition to merchants.

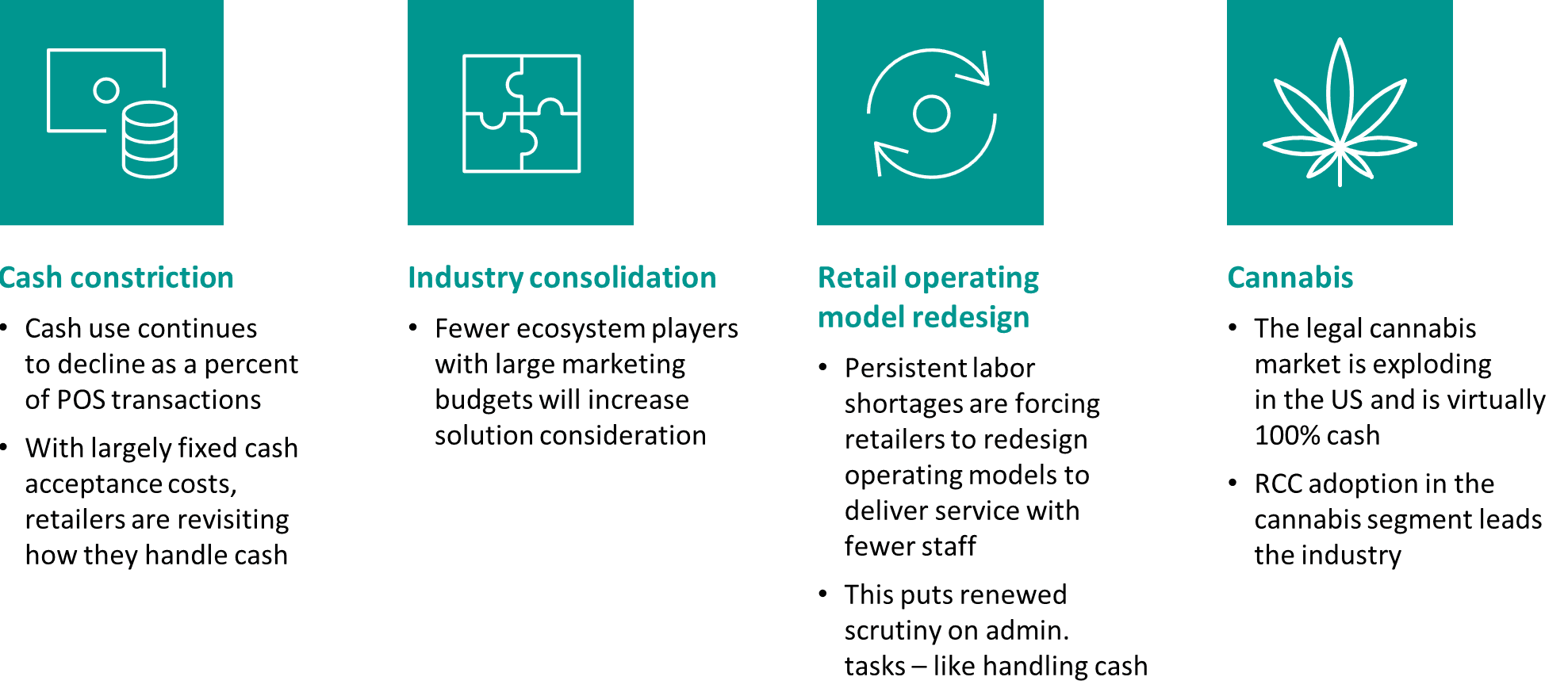

Validating, cash accepting safes have been available since 1995. RCC's first adoptin wave coincided with banks providing provisional credit on validated cash. A second adoption wave came beginning in 2015 as proprietary, closed-loop solutions gave way to open system approaches, simplifying many aspects of solution delivery. RCC is now enjoying a third wave of adoption, driven by four powerful dynamics.

In light of the enduring significance of cash and the growing opportunity that is RCC, banks across the asset tiers should revisit their thinking on being part of the RCC value chain. This report is the best way to begin.