The early 2020s, with its high volatility, high volumes (especially electronically), and lower perceived liquidity, pushed systems in capital markets technology to the max. Celent asked sell side institutions about their strategy and technology priorities going forward in dealing with the new paradigm.

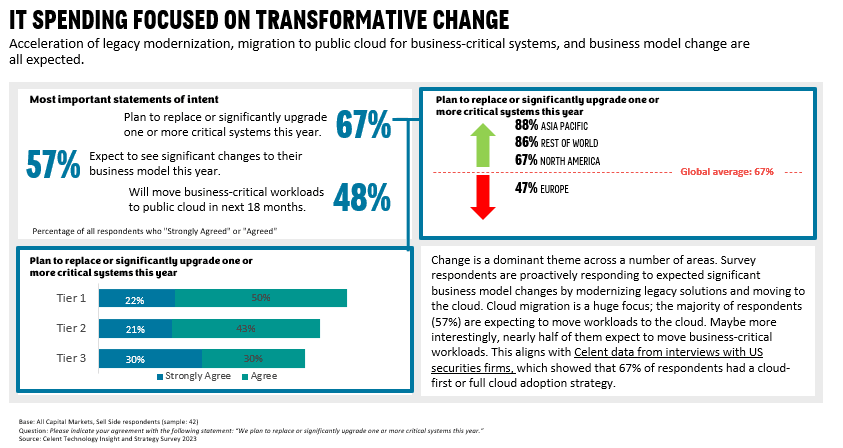

The answer from the sell side is that they are expecting transformative change and funding tech budgets accordingly. The study shows that technology budgets on the sell side continue to grow and suggests a re-acceleration in growth previously interrupted by an uncertain macroeconomic outlook. Driven by the continued fast pace of market structural and technological change, speed and agility and updating legacy systems are major strategic objectives. To achieve these core objectives, significant upgrades to critical systems are in focus for banks, with public cloud adoption accelerating and seen as a foundational part of enabling transformative change.