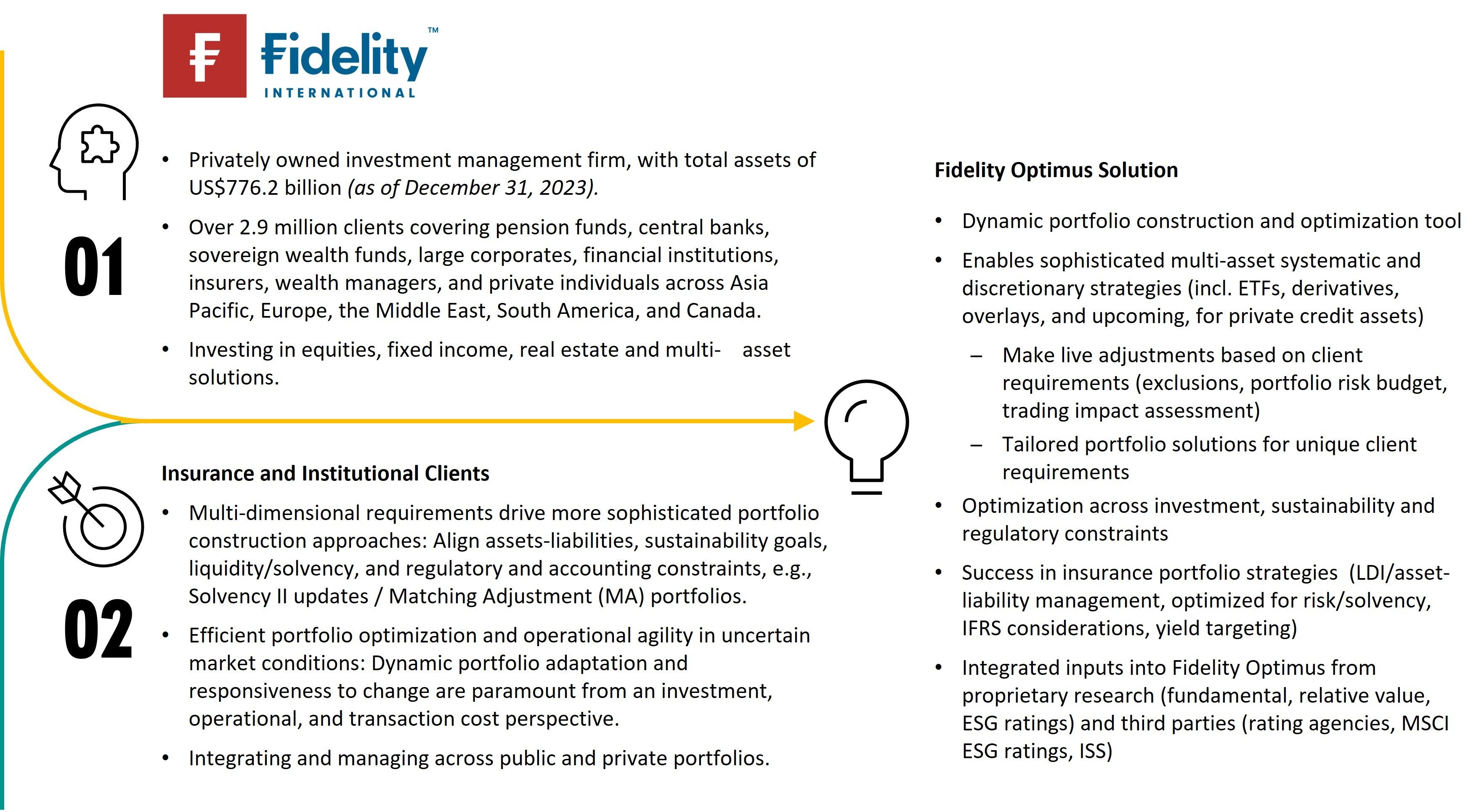

For insurance and institutional clients, efficient portfolio optimization and operational agility from the standpoint of dynamic adaptation and responsiveness to change are paramount from an investment, operational and transaction cost perspective, particularly when facing uncertain and volatile market conditions.

Recent years have seen fixed income and credit investing become more complex due to rising interest rates and increasing regulatory constraints. Pension schemes face challenges in meeting their liabilities while adhering to covenants and evolving ESG/sustainability requirements.

In response to these demands, Celent congratulates Fidelity International for delivering an innovative solution, Fidelity Optimus - that demonstrates collaborative implementation and delivery excellence, to offer clients a technology-augmented investment proposition that enables portfolio managers/engineers to dynamically construct and manage systematic strategies across client portfolios in a tailored, and operationally efficient manner.

Fidelity Optimus enables Fidelity to help their institutional clients to navigate multi-dimensional requirements and more sophisticated portfolio construction approaches, enabling institutional investors to gain access to more effective mechanisms to triangulate and align assets and liabilities, sustainability goals, liquidity/ solvency dimensions, as well as regulatory and accounting constraints.

Our winner case study details how Fidelity International is capitalizing on the success of this initiative.