In the US, the “Big Four” (soon to be the “Big Three”) broker-dealers, Charles Schwab, TD Ameritrade, Fidelity, and E*TRADE, continually go punch for punch with press releases. Adding to the sparring is the corresponding clearing and custody fight between Schwab, Fidelity, TD, and Pershing. The most considerable blows landed in late 2019 with the announcement of commission-free trading. As of this writing, the latest punches came from Fidelity with the announcement of supporting fractional share trading and Morgan Stanley offering to buy E*TRADE. As these firms continue to fight for market share and marketing press, looking under the hood at what these announcements mean for the future of retail brokerage and its corresponding clearing and custody is imperative.

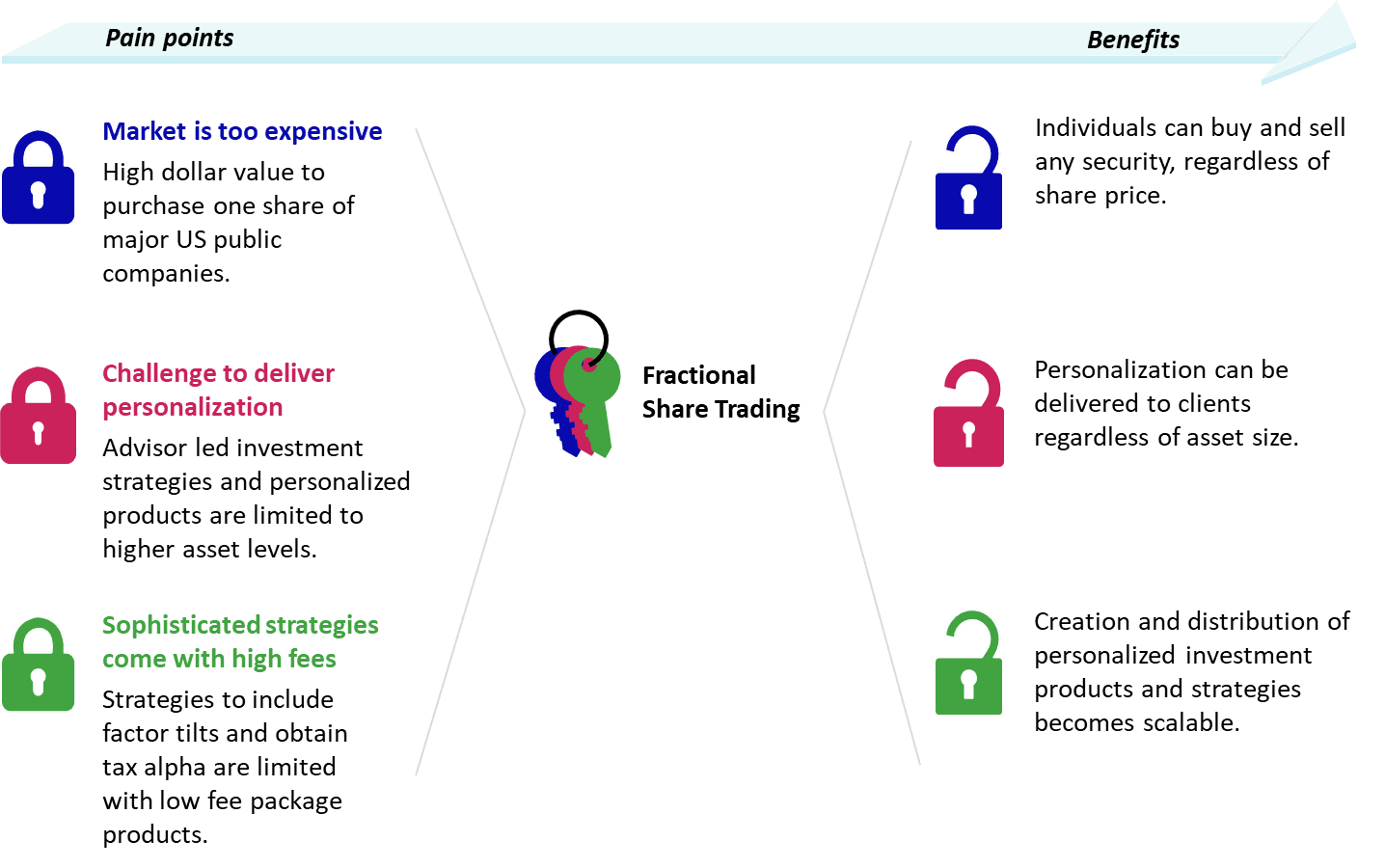

Supporting fractional share trading solves specific pain points investors deal with.

Major broker-dealers are new to zero-commission trades and fractional share trading, but the market is not. “Digital custodians” such as Apex Clearing and Folio Institutional already provide this functionality for wealth managers servicing investors of all sizes. So why are the custodians and their brokerage platforms investing to support fractional share trading?

By discussing certain implications of major broker-dealers offering commission-free fractional share trading provokes questions about the future of clearing and custody and their support for portfolio management and maintenance solutions (as well as product manufacturing) that they can provide.