An Audio with Slides version of the Report

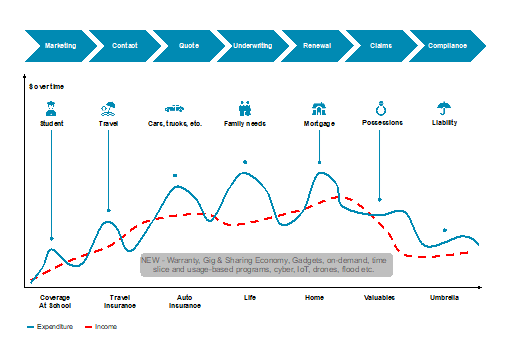

Personal lines insurance is being taken over by consumers and their demand-side expectations for digital innovation and service experiences. Expectations are rising at an accelerated pace, and the choices available in all distribution channels are forcing old products to be modernized while competing against new and innovative digitally transformed programs of insurance.

Beyond personal lines insurance, a similar transformation is hitting consumer banking, mortgage, life, health, content, travel, shopping, entertainment, etc. Connected living is the new norm and it empowers the gig and sharing economy.

Connecting with connected customers amplifies the ecosystem effect in the insurance value chain — “to, with, and through” — direct “to” consumers, “with” independent agents and vendors, and “through” captive agents.

Executives from across the enterprise are scrambling to align with end-customer needs in every link of the insurance value chain. Direct-to-consumer programs are seeing outsized success, putting expense pressure on everyone, and creating a need for an analytic strategy. Multiple innovation and AI pilots are succeeding but creating new tension with IT business partners when proof of concepts and point solutions need to be scaled to production.

Competitors and partners now include insurtech, managing general agencies (MGAs), and new insurers springing up from billions in new capital raised from both within and outside the traditional industry venture capital players.

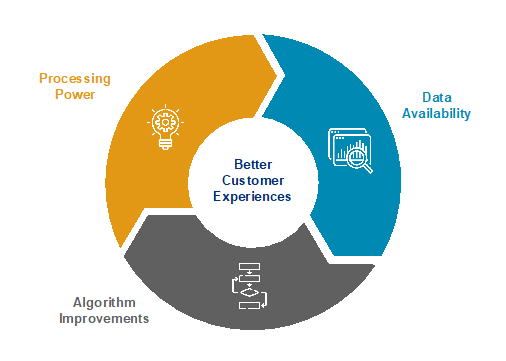

Teams are imagining a new art of the possible where legacy data storage and capacity constraints give way to cloud scale storage, pipelines of data of every kind, new analytics that use new data, and virtually unlimited computational power. Data+AI+Cloud — phones, drones, and sensors augment people with AI.