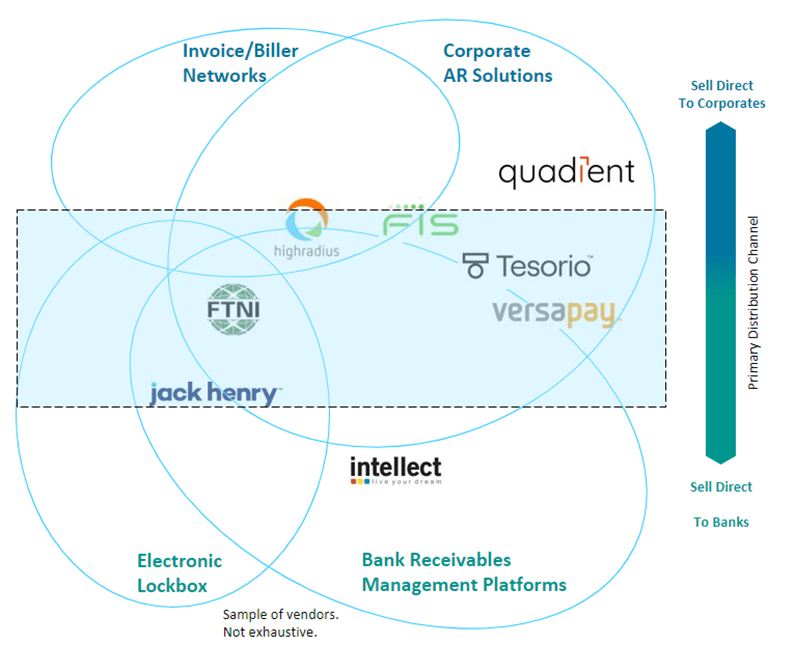

Corporate receivables management platforms have advanced significantly since Celent’s last vendor comparison, yet solutions remain widely varied in how they choose to automate the invoice-to-cash cycle. This includes direct to corporate solutions, direct to bank (for servicing corporate clients), and partnerships between bank and solution vendors.

Banks with solutions in the market need to know what they are up against. Corporate receivables platforms remain a hotbed of development activity, especially in new, cloud-based, corporate-facing solutions that embrace AI in mathing, reconciliation, and forecasting. Most vendors are on rapid or continuous release cycles. Thus, if it has been a year since you have compared solution capabilities, your insight is out of date. We also see banks exploring partnerships with corporate-facing vendors to embed more deeply into client workflows. But this is not without challenges, particularly in terms of cultural expectations.

This companion report to Times are A-Changing: The New Landscape for Accounts Receivable April 2023 will quickly get you current and show what your bank is competing against. In addition to Celent’s comparative analytics, we have compiled eight rich vendor profiles, including a solution overview, advanced technology metrics, key functionality, customer base and feedback, and pricing.

It is important that banks understand how their existing receivables solutions sit competitively with other banks, but also how they compare to offerings from vendors who focus exclusively on the corporate workflow.