European regulators’ desire to increase the security of electronic payments is understandable and well intended. However, the impending Payment Services Directive II (PSD2) requirements for Payment Service Providers (PSPs) to use Strong Customer Authentication (SCA) are poised to disrupt the European commerce market – unless strong two-factor authentication is used for in-scope transactions, issuers will be obliged to decline those transactions.

The challenge is particularly acute for card payments. The SCA requirements are due to come into force on September 14th 2019, but the industry is not ready — according to research by UK Finance, 25-30% of ecommerce card transactions would become impossible to complete as things stand.

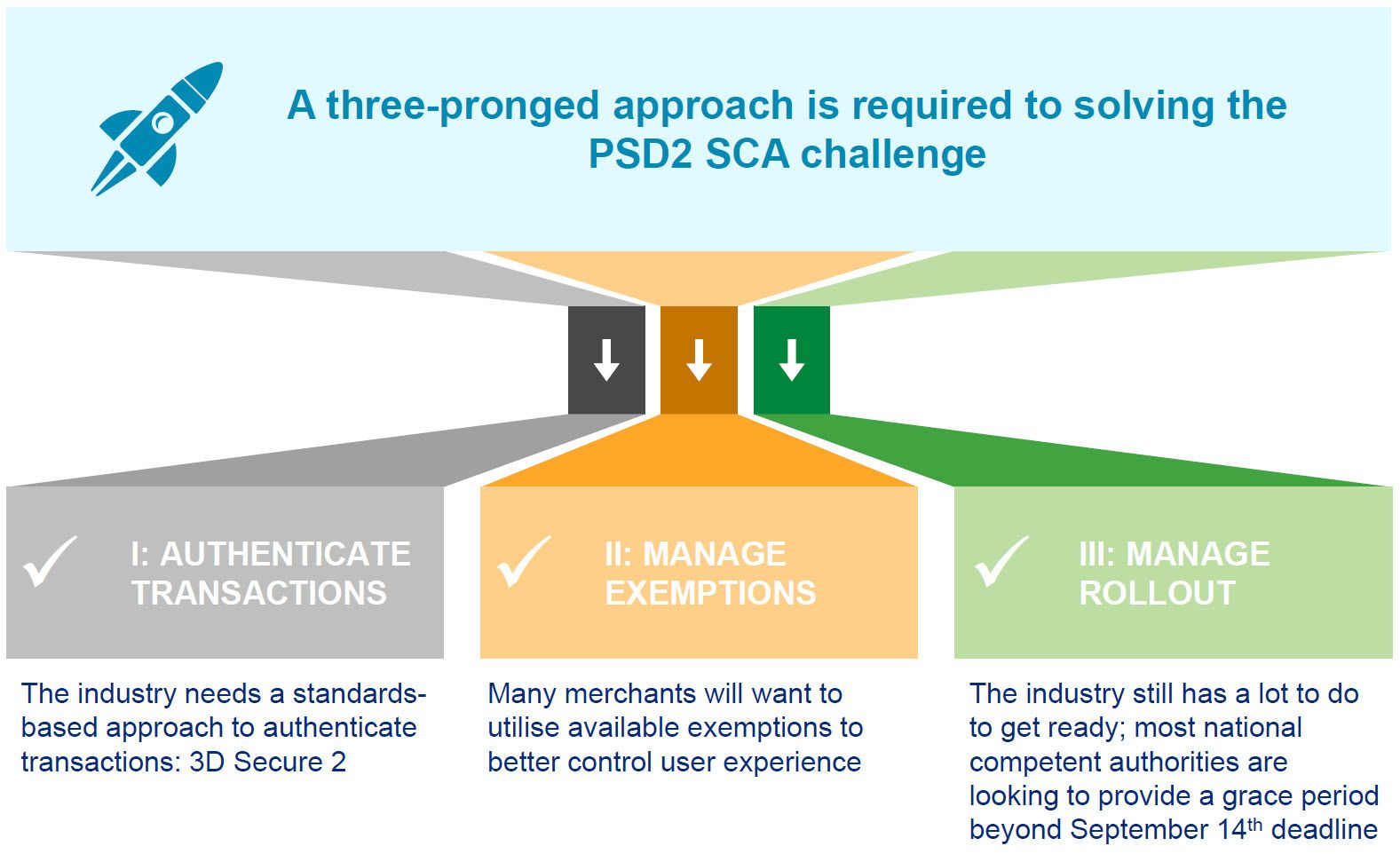

A three-pronged approach is required to solve the problem:

- Implementing an industry standard to authenticate card transactions, such as 3D Secure 2.

- Maximising the use of available exemptions, i.e., when the regulations permit transactions without SCA.

- Delaying the deadline to give extra time for various industry stakeholders to get ready.