EVOLUTION AND REVOLUTION IN RISK AND COMPLIANCE

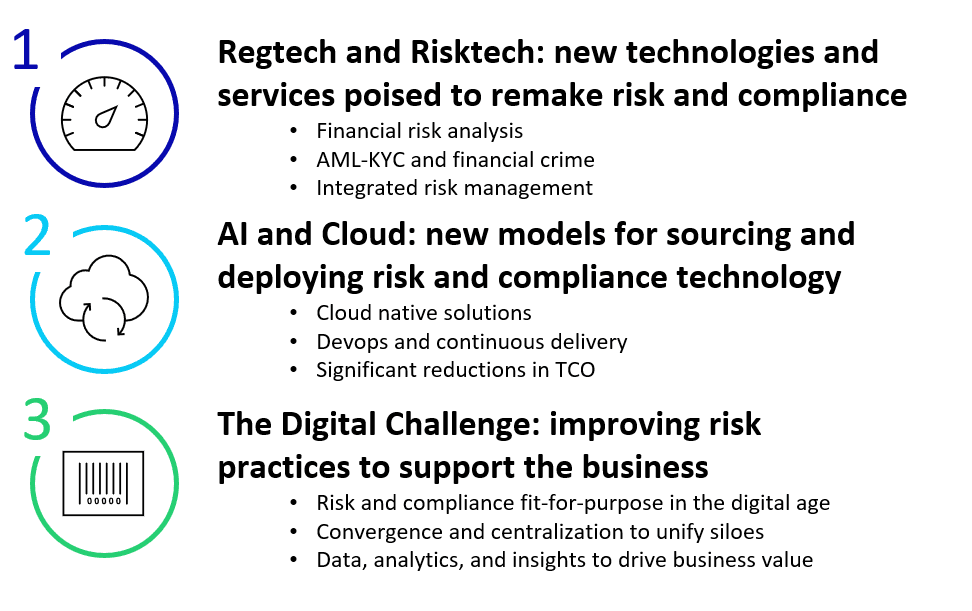

Risk and compliance in the financial industry is at a watershed moment. While continuing to be heavily invested in legacy risk management systems, firms are seeking to use advanced technologies to unify siloed operations and data, derive enhanced insights from data, and overcome traditional trade-offs between efficiency and efficacy. Celent sees three key themes in 2020:

The rapid pace of change associated with digital financial services has many firms questioning what will happen to their business models. We are entering a period where things are not business as usual — many in the industry are expecting significant disruption in the coming decade. Enhancing risk management capabilities will be an important factor in determining winners and losers in a digital world.

Celent’s risk and compliance research focuses on strategy and technology for optimizing financial and operational risk across the financial services industry. We cover regulatory and business developments in financial risk management including market risk, liquidity risk, and credit risk. Our operational risk research centers on financial crime compliance including anti-money laundering (AML) and know your customer (KYC), fraud, and market surveillance; governance, risk, and compliance (GRC); and risk methodologies.

In 2020, Celent will investigate the technologies financial institutions can bring to bear on evolving regulatory requirements; new models for sourcing and deploying risk and compliance technology; and how improved risk practices can support the business in the digital age.

VendorMatch

Celent’s flagship ABCD vendor reports provide in-depth profiles and evaluations of the leading providers of risk and compliance technology. VendorMatch, Celent’s new vendor discovery tool, is playing an increasingly important role in our vendor analysis research. Celent also offers VendorMatch for direct use via freemium and premium service models. See more at https://www.celent.com/vendormatch.

2020 RESEARCH THEMES

Celent’s risk and compliance research will focus on five themes in 2020. While the space changes quickly enough that we’ll respond to fast moving new developments, analysts will be focusing on financial crime compliance, regtech and risktech, artificial intelligence, cloud, and regulation.

Financial Crime Compliance

We are at a critical juncture in financial crime compliance. The first generation of rules-based technology is proving to be inadequate in managing the challenges of the digital era. Despite a considerable evolution in the software systems used for AML, anti-fraud, and trade surveillance operations, the high rate of false positives has resulted in soaring financial crime compliance costs, creating operational bottlenecks and leaving fewer resources available for value-added investigation and analysis. New regulations requiring banks to determine and perform due diligence on beneficial owners of accounts present further operational challenges. To overcome these challenges, firms are exploring AI and other new technologies not only to improve efficiencies and effectiveness of financial crime compliance programs today, but also as an investment that will contain and potentially reduce the ballooning operational costs.

In 2020, Celent will look at how AI, blockchain, and other new technologies are supporting new models for financial crime compliance; and provide detailed profiles and evaluations of incumbent as well as emerging solution providers.

Regtech and Risktech

After decades of slow-crawling development, risk and compliance is suddenly awash in new technologies and services aiming to remake every corner of the field. Many of these services utilize innovative sourcing and deployment models such as continuous delivery-based cloud native solutions. New firms using next generation technologies are providing solutions for AML-KYC, integrated risk management, regulatory change management, financial risk reporting, and other areas. This includes the rapidly growing universe of regtech startups, as well as technology and compliance pioneers that have been working in the space for a decade or more. And in terms of in-house initiatives, financial firms are exploiting next generation enterprise-grade data and AI/quantitative platforms to reduce risk.

In 2020, Celent research will seek to cut through the hyperbole surrounding regtech and provide a common-sense approach to understanding, evaluating, and keeping track of this fast-moving space, supported by VendorMatch (https://www.celent.com/vendormatch).

Artificial Intelligence

Artificial intelligence is best thought of not as a single solution that fixes all problems, but as a toolkit with a range of analytic capabilities that can be applied to specific pain points. AI, data lake-based big data, and machine learning are powering convergence initiatives such as centralization of enterprise risk data and early warning systems for financial risk. On the operational risk side, the failure of rules-based scenarios to control false positive rates has made AML and other compliance processes in the financial services industry barely manageable. To augment legacy risk and compliance systems, financial institutions will require a combination of AI, machine learning, and intelligent automation techniques.

In 2020, Celent will continue to examine how firms can apply these technologies to their risk management and compliance operations while managing the implications from the people, technology, and regulatory points of view.

Cloud

Cloud is becoming an important platform for building innovative models for risk and compliance. By automating infrastructure provisioning and leveraging devops techniques, cloud enables a velocity that has not been possible previously. Cloud frees teams to focus on business differentiators rather than plumbing, provides access to high-powered CPU capacity and virtually unlimited data storage, and supports the development of smarter solutions based on advanced analytics, AI, and machine learning to enable advanced compliance practices. Plus, even as they turbocharge analytic capabilities, cloud infrastructures and solutions can significantly reduce operating costs.

In 2020, Celent will cover the emerging impact of cloud models on risk management and compliance, including new solutions and services as well as specific use cases and case studies.

Regulation

Regulatory change continues to be the sine qua non driving much of the risk and compliance framework for both financial risk and operational risk. Over the past decade, regulatory changes have led to a substantial increase in minimum capital and liquidity requirements and reduced returns on balance sheets. As a result, financial risk management has become central to any business strategy discussion. Firms face a gamut of risk management requirements ranging from CCAR stress testing exercises to the FRTB market risk framework to revamped loss forecasting called for by CECL / IFRS 9 — and IFRS 17 for insurers. At the same time, compliance requirements continue to mount, including data protection (GDPR, PSD2, CCPA) and financial crime compliance (MLD 5, CDD Rule, NYDFS 504).

In 2020, Celent will focus on regulatory developments and how financial firms can use next generation technologies and platforms, such as AI and cloud, to help them meet the increasing complexity and challenges of regulatory compliance.

Contact us for more information about what we have planned in Q1.

If you are a client, please sign in to access a detailed view of our Q1 2020 agenda.