I had an opportunity to view an Amazon Web Services (AWS) demo called the "Wealth Management AI Advisor" (“AI Advisor”) on display at the financial services industry booth in the AWS re:Invent industry pavilion. The demo showcased how generative AI can redesign and transform advisor workflows which traditionally have been overly manual, inefficient, and time-consuming. Through the integration of advanced machine learning algorithms and data analytics, the demo creates an end result that improves an advisor’s efficiency and provides more personalized financial advice and investment strategies for clients, thus allowing advisors to serve more clients and provide better service.

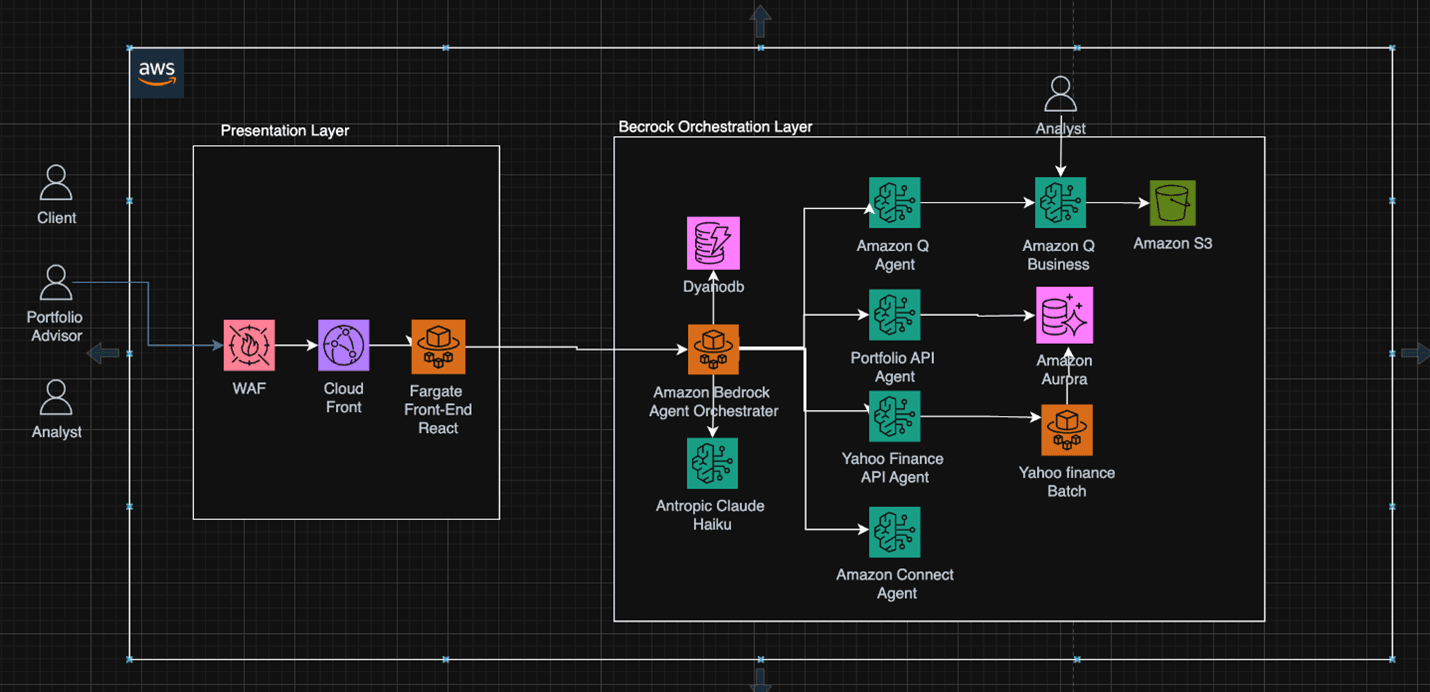

The demo from AWS is a sophisticated AI-powered agent designed specifically for wealth managers. The tool demonstrates how to reduce preparation time for client meetings, featuring research and analysis capabilities that process large datasets at speeds two-to-three times faster than traditional methods. By leveraging AWS cloud infrastructure and generative AI services, the AI Advisor digests and analyzes complex financial data, including earnings call recordings, 10-K reports, stock and fund data, and clients' portfolios. This enables wealth advisors to receive instantaneous insights and recommendations, empowering them to make informed decisions with speed and accuracy.

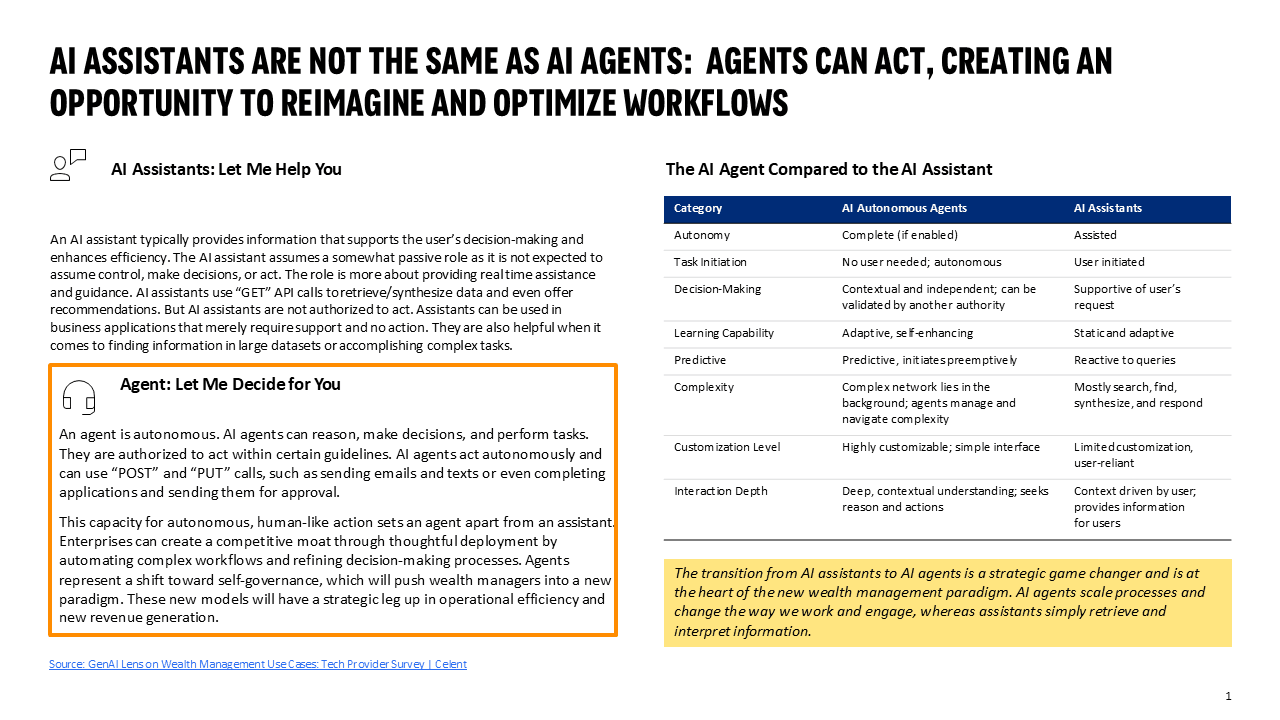

Celent has studied the application of AI and GenAI across financial services, including within wealth management processes. In that segment, the technology is changing how advisors operate, enhancing both efficiency and client/advisor satisfaction. Today, we’re seeing significant discussion around the shift in use of GenAI. For example, GenAI agents are role-based applications that specialize on a specific task or objective. They act autonomously to determine the best way to complete their task. By utilizing multiple agents, a multi-agent system can be created in which agents coordinate and collaborate to solve complex problems and automate processes. In the case of wealth management, they have significant potential to transform advisor and employee workflows by streamlining processes and providing actionable insights.

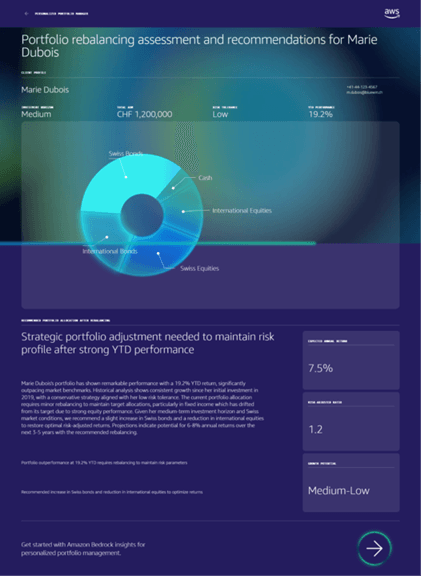

The AWS demo offers functionalities like portfolio management and recommendations, detailed stock information, and access to investment details. The AI agents maintain a comprehensive financial knowledge base, which includes access to critical financial documents, thereby supporting advisors in making informed decisions. The role of AI agents extends beyond data analysis; they are instrumental in the potential transformation of the client experience. By automating the preliminary stages of wealth management, these agents enable advisors to dedicate more time to building relationships and understanding client needs.

The AWS demo offers functionalities like portfolio management and recommendations, detailed stock information, and access to investment details. The AI agents maintain a comprehensive financial knowledge base, which includes access to critical financial documents, thereby supporting advisors in making informed decisions. The role of AI agents extends beyond data analysis; they are instrumental in the potential transformation of the client experience. By automating the preliminary stages of wealth management, these agents enable advisors to dedicate more time to building relationships and understanding client needs.

AI Advisor is powered by AWS services, where tools such as Amazon Bedrock, which provides a choice of LLMs including Amazon Nova and Anthropic Claude models, as well as Amazon Q Business can be integrated behind a user-friendly application interface. This setup aggregates data and presents it in a way that is easily digestible for advisors. The interactive experience provided by the AI Advisor aims to ensure that wealth management firms can equip their advisors with the tools necessary to deliver personalized advice to their clients.

The AI Advisor demo illustrates the potential change that is ahead within the wealth management industry, particularly around offering faster data processing, integrated platforms, and user-friendly interfaces that ultimately redefine client interactions and workflow automation. The demo offers a blueprint for a streamlined and comprehensive dashboard for managing financial insights, ensuring that wealth managers can swiftly and securely access detailed portfolio actions, stock specifics, and investment information. As seen with the AWS demo, the integration of AI agents into advisor workflows represents the start of a new era of modernization within wealth management.