As we venture into 2020, evolving regulations and changing consumer behavior will impact insurers. Cybersecurity, data privacy, and customer protection continue to shape new challenges and trigger regulatory scrutiny.

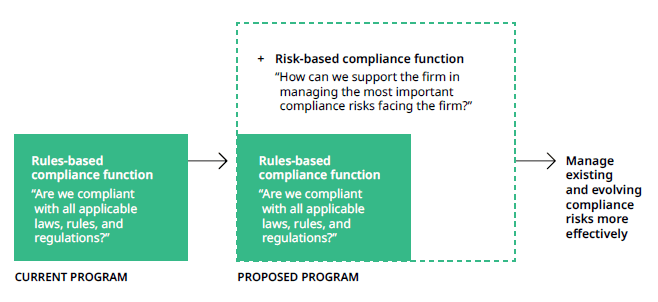

As an insurance leader, you may already be considering how to address regulatory and risk management challenges—and it’s a daunting task. At Oliver Wyman, we have been working with clients to solve these issues and more effectively manage compliance risks. Our paper delves into the challenges and impacts our clients are facing. We present the strategic changes and quick wins needed to effectively manage compliance, including how to develop a risk-based compliance program, increase engagement with the overall business, and fully align other non-financial risk functions.