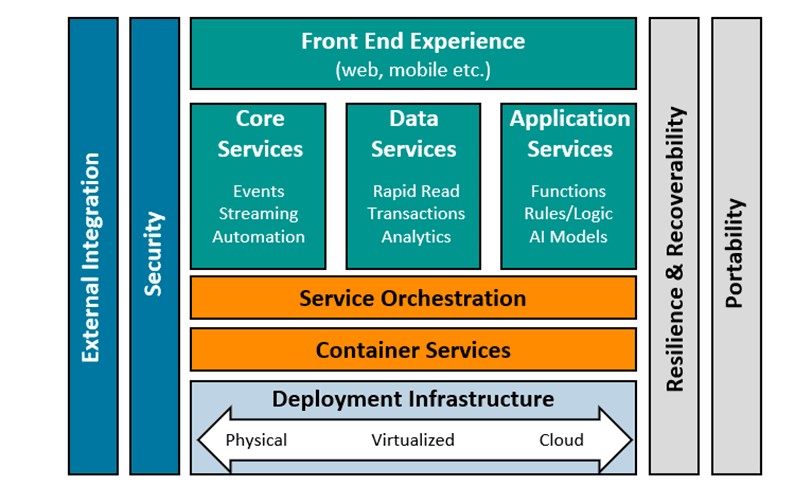

There is a tendency to talk about “buy versus build” development paradigms for banking solutions. Today, with the rapid changes in technology architectures, there are no true “buy-only” options. Everything requires some build to deliver a differentiating experience. Minimally the build is integration from vendor applications to the rest of the bank, but increasingly the world of microservices allows composite services to be delivered as a combination of vendor and bank functionality. Key architectural trends modernizing banking are:

•APIs, microservices, and containers are now mainstream building blocks.

•A shift in the cloud value proposition from cost-based to value-based.

•Data strategy and data platform capabilities play a more significant role than before—including the AI enablement across banking platforms.

•Security expectations ramping up. Multifactor authentication is de rigeur, but a few banks and vendors are also exploring zero trust security architectures.

•Resilience has always been a primary design consideration, but the characteristic of portability (vendors and platforms) increasingly comes into play.

Banks looking for product innovation and process improvement must look deeper at the underlying architectural components to decide the path forward. The trends in corporate banking technology are clear. Cloud, APIs, and microservices are no longer innovative, they are expected. Banks looking to modernize corporate digital banking platforms and channels need to be aware of the new architectures and solution designs that are available today yet will underpin the bank for tomorrow. In addition to a survey of vendor capabilities, the solution approaches of three major banks show how banks are utilizing many of these transformation-enabling technologies.