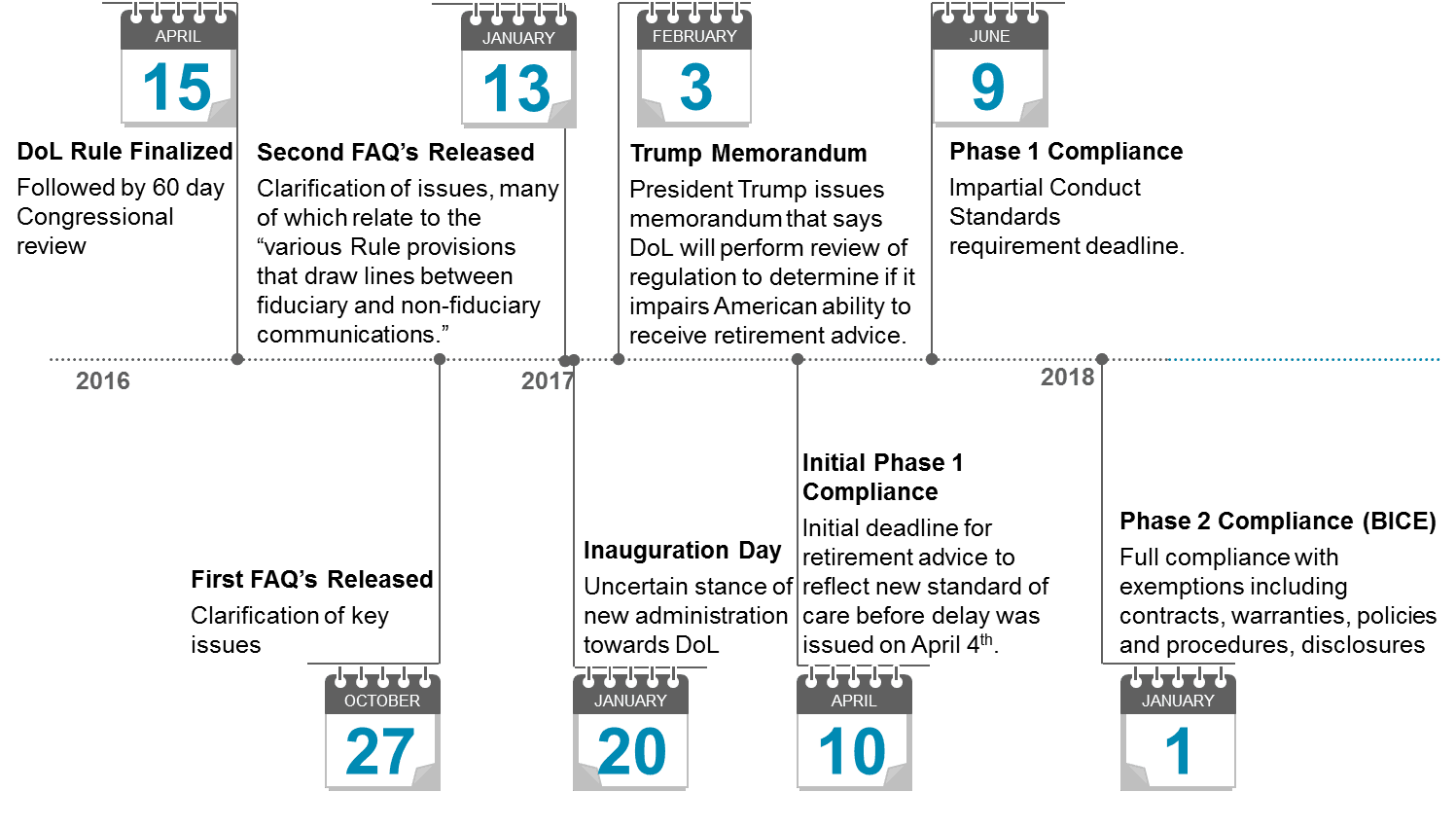

A month ago, on April 4, 2017, less than a week prior to the scheduled implementation date for the first phase of Department of Labor (DoL) Fiduciary Rule to go into effect, the DoL filed to delay the regulation by 60 days. Therefore, as of now, the DoL Fiduciary Rule is scheduled to go into effect June 9, 2017. The DoL has also said that all requirements except for the Impartial Conduct Standards will be deferred until January 1, 2018.

Simultaneously, the DoL is undertaking a review of the rule to determine whether or not the regulation as it stands now could hurt Americans ability to get retirement advice. This review is expected to be completed by January 1, 2018.

The chain of events has generated uncertainty for financial institutions who provide advice to retirement plans, plan sponsors, fiduciaries, beneficiaries, individual retirement accounts (IRAs), and IRA owners. For the past year, these financial institutions, which include firms of all sizes, have been forced to rethink their technology that supports their compliance efforts, including but not limited to how advisors justify recommendations and document those recommendations.

This effort has not gone to waste. The compliance tools and training packages that have come out of this effort to quickly comply with the DoL Fiduciary Rule will have lasting impact and use cases for a much larger audience, including anyone in the field of delivering investment advice or investment products, regardless of what happens with the DoL Fiduciary Rule.

In my latest report, Regulation as an Impetus for Change: Technology Solutions for Fiduciary Responsibility, I study products that make compliance with the DoL Fiduciary Rule simpler and more efficient. Vendors covered in this report include: Broadridge, Fi360, InvestCloud, Morningstar and SEI . Solutions include product shelf assessment services, refined education and training programs and dashboards, and products that help advisors prove that they are working in the best interest of their clients.