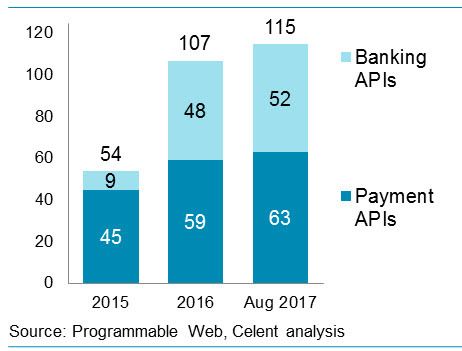

Secure, publicly accessible application programming interfaces (APIs) have been around for more than ten years in the financial services sector. Many popular e-commerce platforms deploy APIs, exposing various features of their underlying platform to third party application developers. These include PayPal, Stripe, Authorize.Net, and LevelUp. Now, regulatory initiatives in Europe (PSD2) and the UK (Open Banking) are driving banks to create open API developer portals to allow third party access to customer banking data and payment initiation. In fact, according to ProgrammableWeb.com’s global API directory, banks and fintech firms published more than 275 new payment and banking APIs in the past 2 ½ years.