2018年、INGはアプリケーション開発を再考し、アジャイルで大規模な変革の枠組みの中で変化を推進する複数年のプログラムに着手した。この枠組みは、ホールセール銀行と投資銀行全体にさらなるデジタル化への道を開き、ビジネスを行うプラットフォームの成長を後押しするものである。

この取り組みにより、主要な利害関係者が適切なフォーマットのデータに適切なタイミングで確実にアクセスできるツールが構築された。またINGは、構成可能なビルディング・ブロックやデータ中心性、さらにはグローバルなチームが管理するワークフロー、視覚化、可監査性およびリスク管理を提供する総合的なプラットフォームを活用することで、業務効率の向上とリスクの低減を目指した。その際、クラウドやマイクロサービスを含む最新のテクノロジーを使用し、フィンテックのパートナーシップに依存するというアプローチがとられた。同行は、プラットフォームエコシステムを導入することで、主要な利害関係者へのエンドツーエンドのデジタルエクスペリエンスの提供を可能にした。これには、プロセスの合理化と、フロントオフィス、ミドルオフィス、バックオフィスのユーザーの中核的能力の強化も含まれている。

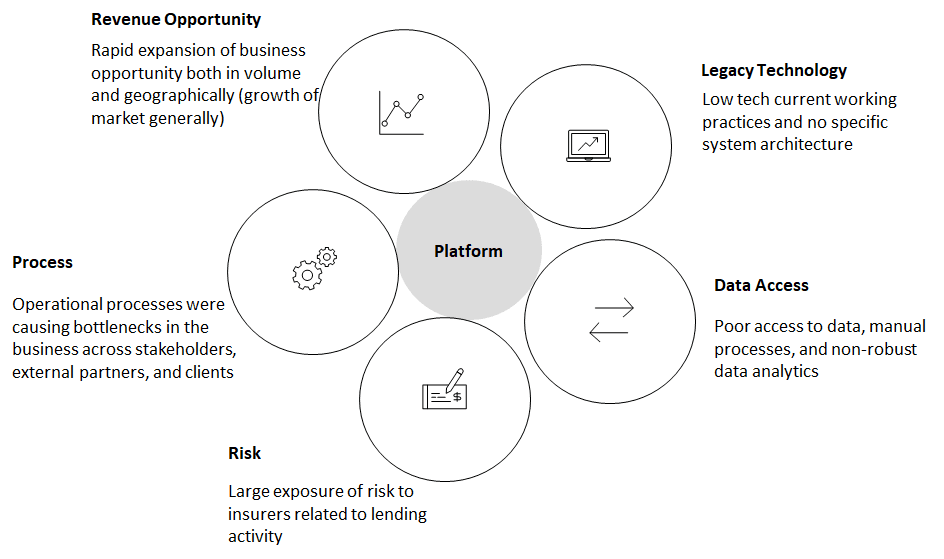

INGのデジタルトランスフォーメーションにおける5つの基準:

このケース・スタディーでは、プロジェクトの識別とスコーピング、ローコード/ノーコード(LCNC)プロバイダーであるGenesis Global Technology Limitedと協力してソリューションを作成するとした判断、INGの成果、およびINGと市場エコシステムの全体にわたるINGの信用保険取引のワークフローとポートフォリオを管理するプラットフォームの成長に向けた将来の計画の観点から、INGのデジタル化推進プロセスの道のりを検証する。