Geopolitical and economic waves have shocked markets around the world. In a period of disrupted supply chains, accelerating inflation, and rising interest rates, companies of all sizes face challenging times ahead. More than ever, they will turn to their banks as trusted advisors to help them weather the storm, but they will also be more selective in their bank relationships. As a result, banks face increasing competitive pressures amid market uncertainty. How banks invest to differentiate, while supporting their clients, will be critical.

In response, leading banks will seek to deepen client relationships by optimizing customer engagement, delivering innovative intelligent treasury solutions, leveraging data and analytics, and accelerating payments capabilities. To achieve these ambitions, they will continue investing in modernizing platforms, developing advanced data management strategies, and expanding partner ecosystems with API frameworks.

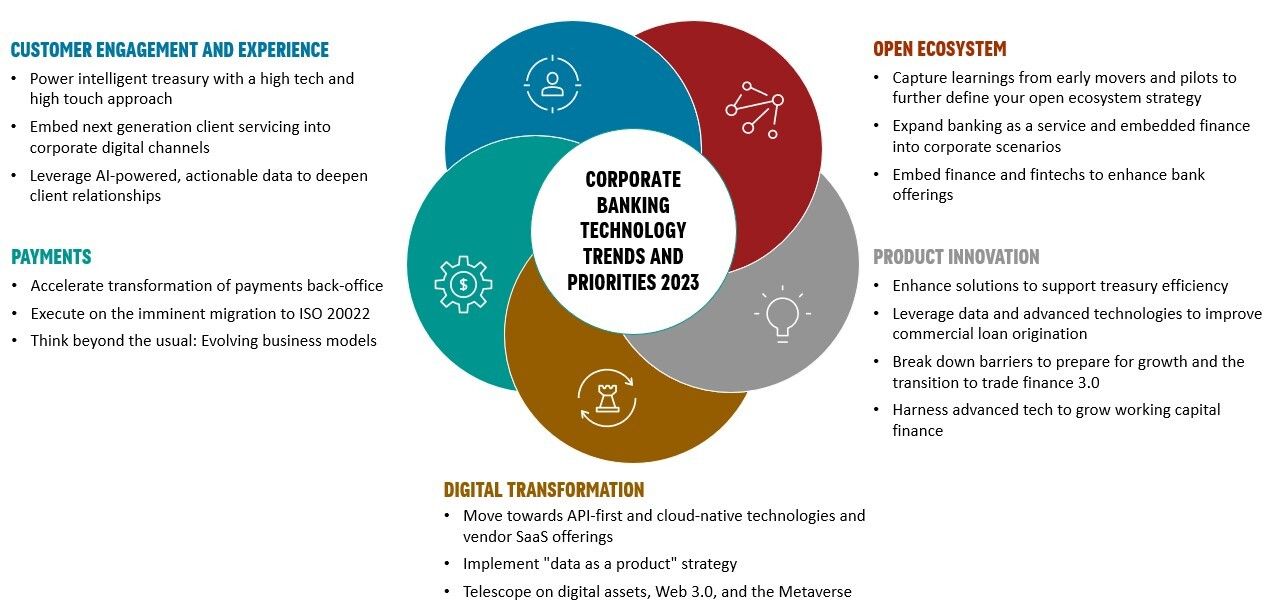

Similar to last year, this 2023 edition of the Corporate Banking Technology Trends Previsory summarizes Celent’s guidance to clients around five key industry themes and 16 corporate banking technology priorities for 2023. The five themes are consistent across Retail and Corporate Banking and will guide our research agenda for 2023. As always, the report draws on some our recently published insights, but much of the content is new, published here for the first time.

Figure: Summary: Key Technology Trends for Corporate Banking in 2023