Shelter-in-place and attendant work from home have been a litmus test for the state of digitization at banks. Those in the vanguard have fared relatively well in handling the dramatic shift to digital channels. The rest are diagnosing their weaknesses and reevaluating their digital transformation plans.

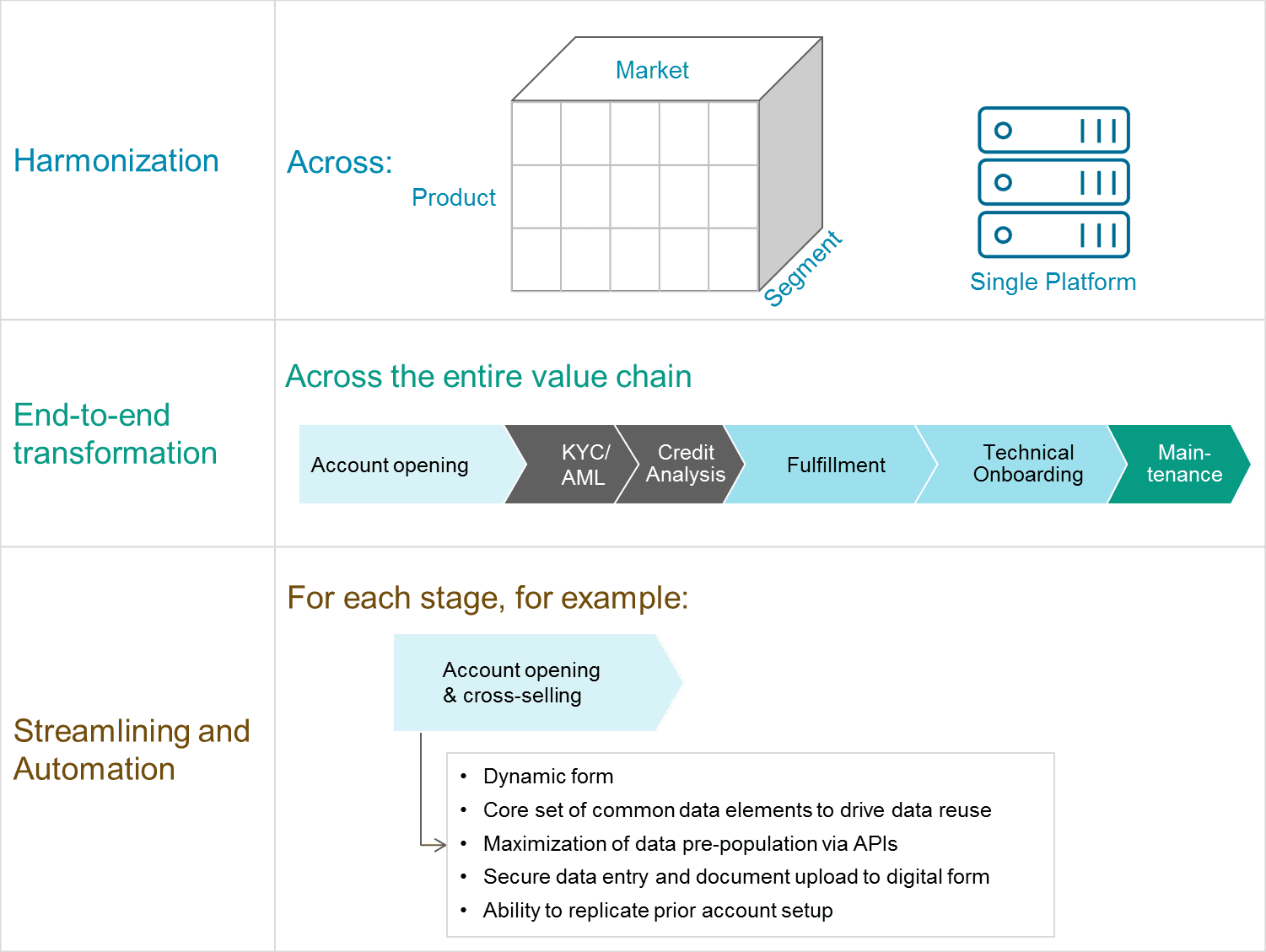

In the new abnormal, digital onboarding has risen on the priority list. As banks map more ambitious digital plans, they should consider three high level goals:harmonization across markets, products, and segments, end-to-end transformation, and streamlining and automation for each stage of the customer journey.

Three High Level Goals:

Digitizing commercial and corporate customer onboarding requires not only resources but also fortitude and perseverance. The size of the prize makes the effort worth it. Successful top tier banks report a dramatic reduction in onboarding times from weeks to days. The revenue boost from serving a large corporation three weeks sooner could easily be more than $100,000. Moreover, the beginning of a client relationship sets the tone for deepening the relationship. Banks in the digital vanguard have found that if clients have a positive digital onboarding experience, they will likely use both the bank’s self-service and unattended (host-to-host) channels more.

Clients are not the only winners. Banks state that their relationship managers report improved job satisfaction because they can focus more on adding value for clients by gaining 10% to 15% extra capacity. The bank overall wins by reducing their costs through automation and error reduction, with some reporting errors down from 60% to 5% and processing time down as short as a sixth of the time.

For further discussion, subscribers to Celent Corporate Banking research can access Digital Customer Onboarding Vendor Spectrum: Corporate Banking Edition, which includes a discussion of best practices. For a small business focus, see Digital Customer Onboarding Vendor Spectrum: Small Business Banking Edition.