This report represents the Financial Markets Infrastructure edition of the Capital Markets Previsory 2023 report series. While FMIs are benefiting from the volatility stemming from geo-political disruption and global economic downturn, they find themselves adapting to a new digitalized ecosystem. In some cases, competition from fintechs is spurring new innovative product offerings and/or expansion into new asset classes, such as digital assets.

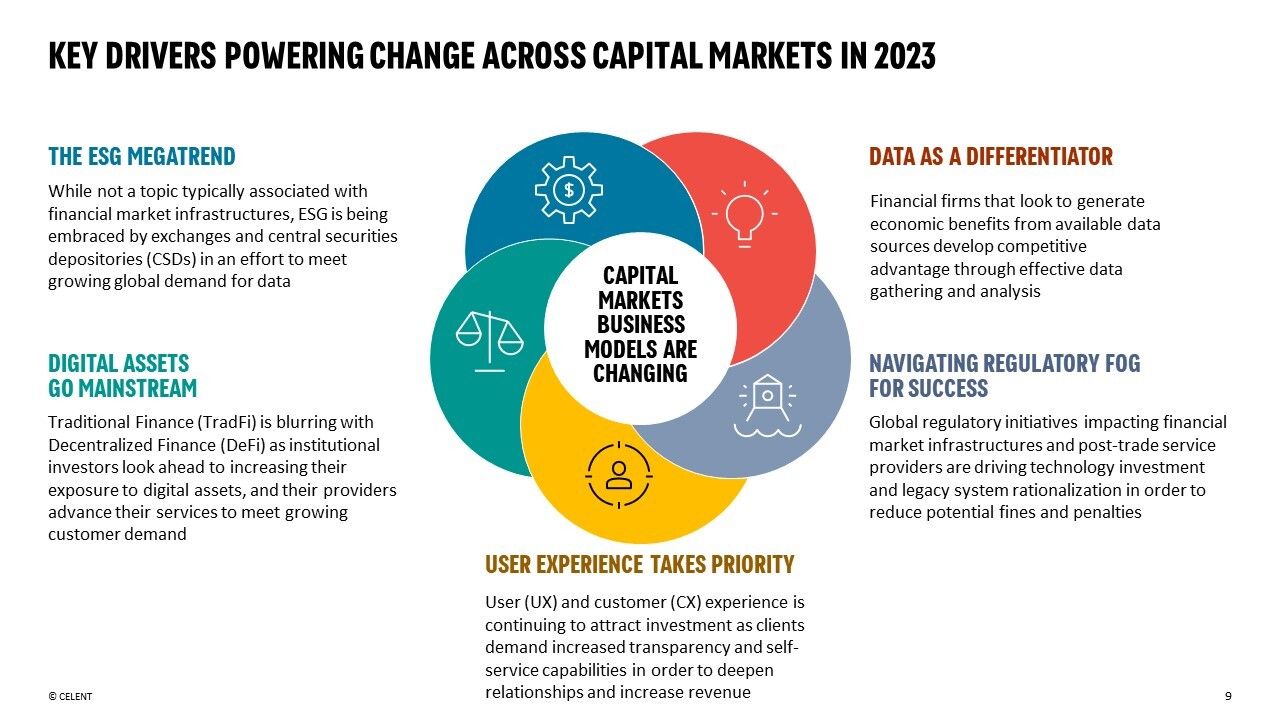

The Capital Markets research team has identified five key themes impacting the industry today, and driving future investment in technology. We further identify key technologies related to each theme in a series of three reports: Sell-side, Buy-side, and FMIs. Each report shares key takeaways and case studies of how technology is being applied across the three segments.