I had the opportunity to attend SAS Insights 2025 in Cary, NC from February 26-28. This analyst-only conference was held at SAS headquarters with ready access to many SAS senior exectives, subject-matter experts at numerous SAS product demonstrations. It was a a multi-industry event with the heaviest focus on banking (which accounts for the largest share of SAS revenues), insurance, and government. The conference included presentations and discussions of company business strategy, product strategy, and recent product releases.

Company Strategies

Company strategies included expanded cloud deployment, target market segmentation, partnerships, and new/enhanced decisioning products.

Cloud deployment. In 2025, SAS is adding the partner tenant hosting option to its current on premise, SAS hosted and customer tenant options. SAS also intends to add an as-a-service option in 2026. These deployment options are meant to provides customers with the platform flexibility they seek and to address consumption based pricing and lowering total cost of ownership.

SAS Viya in the Cloud is progressing towards being fully cloud service provider (CSP) agnostic. It was originally deployed with Microsoft Azure. In 2024 SAS partner Deloitte helped deploy it on Amazon Web Services (AWS). Next up is Google Cloud Platform (GCP) in the near future, possibly in 2025.

SAS Managed Service (it was originally called SAS Cloud) has had five consecutive years of double digit cloud revenue growth. SAS also cites industry analyst studies that it is far less expensive to run than competing technology stacks.

Market segmentation: SAS for the masses. Another overarching core strategy mentioned is to bring data, AI and SAS solutions to firms of all many sizes. Known for having many large banks, insurance companies, and government agencies using its on premise solutions, SAS’ downmarket strategy will leverage SaaS/cloud deployment of SAS solutions. SAS has been making this deployment technology transition for many years, although some of its long-time clients with on premise solutions are less familiar with SAS’ technology advances.

Partnerships. SAS is increasing emphasis on partnerships in two ways: first, to support global sales in countries where a large in country SAS presence (infrastructure, staffing, etc.) isn’t economical given the addressable market size; and second, to embed SAS into other solution provider’s ecosystems. For example, SAS partners with Experian to provide SAS solutions on the Experian Ascend Analytical Sandbox, which is an advanced analytics environment that provides data visualization, business intelligence and model development in a cloud environment. Financial institutions use the solution to develop, test, and deploy models. It includes analytical tools from SAS and other software (R, Python, H2O, and Tableau), as well as access to SAS Viya.

Product Strategy: Analytics/AI. SAS product strategy is focused on-but not limited to-productizing AI models. In 2024 SAS released 12 AI models as independent products, with plans to implement more AI models in 2025.

Any important aspect of AI and GenAI solutions is focused on AI Governance and “responsible AI”. New models require new forms of governance, especially GenAI models where data sources are less known and explainability is less certain that with regression based models. For example, SAS cited a research study where undocumented, public data in large language models (LLMs) introduced bias in the LLM’s analysis of previously underwritten US mortgage loans (Measuring and Mitigating Racial Disparities in Large Language Model Mortgage Underwriting) due to the introduction of public internet data into the analysis. LLMs recommended more denials and higher interest rates for black applicants than similar white applicants. While other studies based on deterministic models have reached similar conclusions, LLMs compound the effect of other dimensions of disadvantage. SAS addresses thes GenAI challengs by identifying use cases where some LLMs cannot be used without unacceptable compliance risk, putting guardrails around data sources, and documenting model outputs.

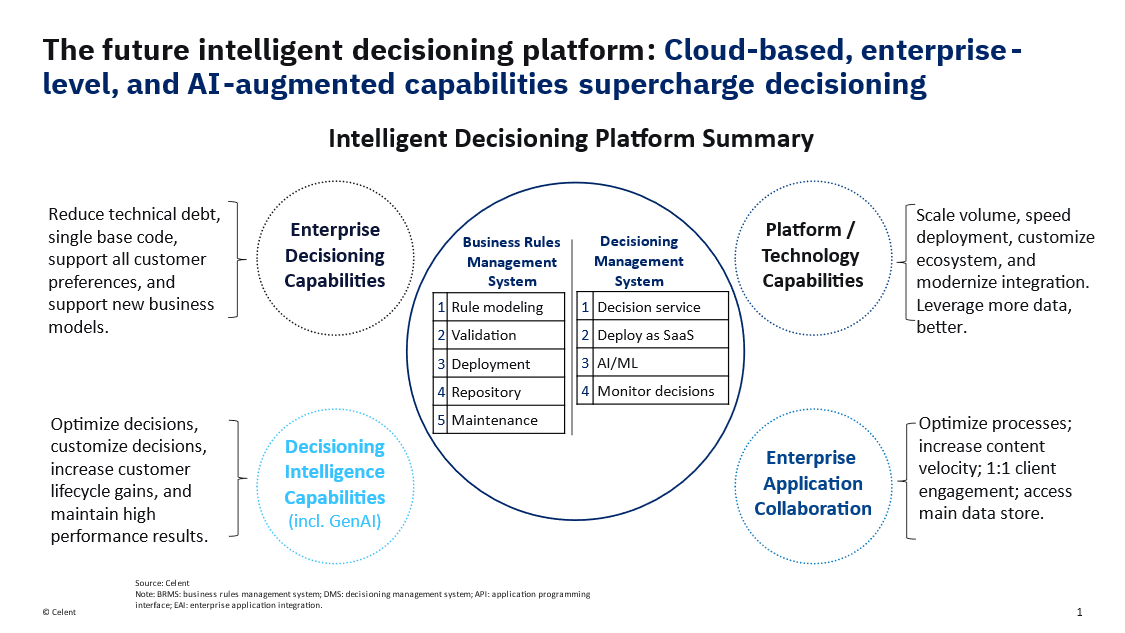

Product Strategy: Intelligent Decisioning in Lending. A safer and productive approach to the use of LLMs is to integrate them with proven, explainable, deterministic models. For example, gradient boosting, a deterministic model (when using the entire training set at each iteration, meaning it will always produce the same prediction for the same input data given the same parameters) can be augmented by LLMs. Figure 1 presents Celent’s view of how intelligent decisioning platform combine the the deterministic modeling of decisioning management systems with the decisioning intelligence capabilities from GenAI.

Figure 1

Source: Celent

Celent has covered cloud-based, intelligent decisioning systems extensively in our recent report, Next-Generation Intelligent Decisioning Platforms: Shifting to the Enterprise and Cloud to Modernize Front and Back Office Retail Loan Decisioning.

Looking Ahead

Contact me at info@celent.com or cfocardi@celent.com if you would like to discuss lending, analytics, data management, etc. If you are a client, email me or your relationship manager to set up a call.

Other Related Research