企業が運転資本を調達する際にフィンテックが大いに活用されていますが、それには相応の理由があります。企業の資金ニーズは十分に満たされない場合が多いうえ、申請プロセスにも非常に時間がかかることがあります。革新的なフィンテック企業や銀行を利用すれば、申請プロセスの改善や迅速化につながるだけでなく、企業側の業務フローの一部に組み込むことも可能になります。

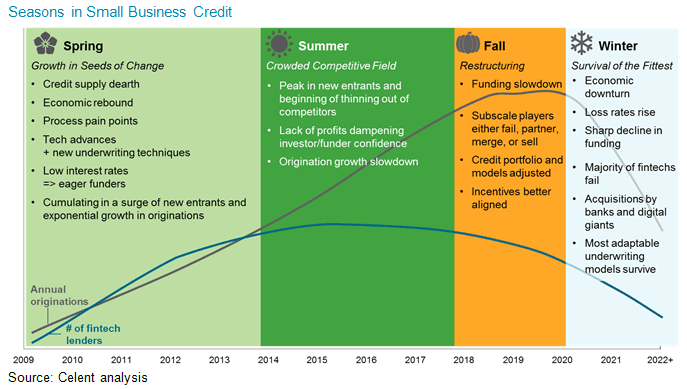

中小企業向け融資市場(Small business credit: 主に$250,000以下の短期融資)は活況を呈しています。金融危機と景気後退後の厳しい冬の時代を経て、あちこちに撒かれたイノベーションの種がベンチャーキャピタルの投入する資金という肥料によって成長し、春を迎えて新世代の与信業者の誕生という実を結びました。ところが、夏場になってその勢いは先細りしつつあります。オリジネーションは増加傾向が続いているものの、事業者の数は減少に転じています。収穫と計画の時期である秋はすぐそこまで迫っており、その後は冬が到来するでしょう。

夏の終わりは、市場と関連する事業者を評価する上で最適のタイミングといえるでしょう。本レポートでは前述の春と夏の動きを詳しく検証した上で、秋とその先の冬に向けて各事業者がいかに備えるべきかを考察します。また、競合プレーヤーがひしめき合うこの市場環境を調査し、与信業者を次の3つのカテゴリーに分けて分析します。① 既存の与信業者、② 大手IT企業(アマゾン、ペイパル、スクエア)、③ フィンテック企業(ベンチャーキャピタルが出資する金融テクノロジー会社)

本レポートと対を成す「中小企業融資の最新動向 パート2: イノベーティブな14社の分析」では、ベストプラクティスを実践する14の事業者に焦点を当てて分析します。