In today's interconnected world, seamless cross-border transactions are essential for businesses aiming to succeed globally. Business-to-business (B2B) cross-border payments are crucial for international commerce, enabling trade, expense management, and growth investments. This research paper analyzes the B2B cross-border payments sector, focusing on its evolution, strategic importance, challenges, and growth potential, providing insights for banks to enhance their payment strategies and global competitiveness.

B2B cross-border payments facilitate transactions between businesses across countries, covering trade, operating expenses, capital purchases, and treasury management. The complexity of these payments arises from navigating various channels, including traditional banking and digital platforms, while adhering to diverse regional regulations and currency restrictions. The global market for B2B cross-border payments is experiencing significant growth, projected to expand from US$24 trillion in 2019 to US$52 trillion by 2030, driven by globalization, technological innovation, and the rise of B2B e-commerce.

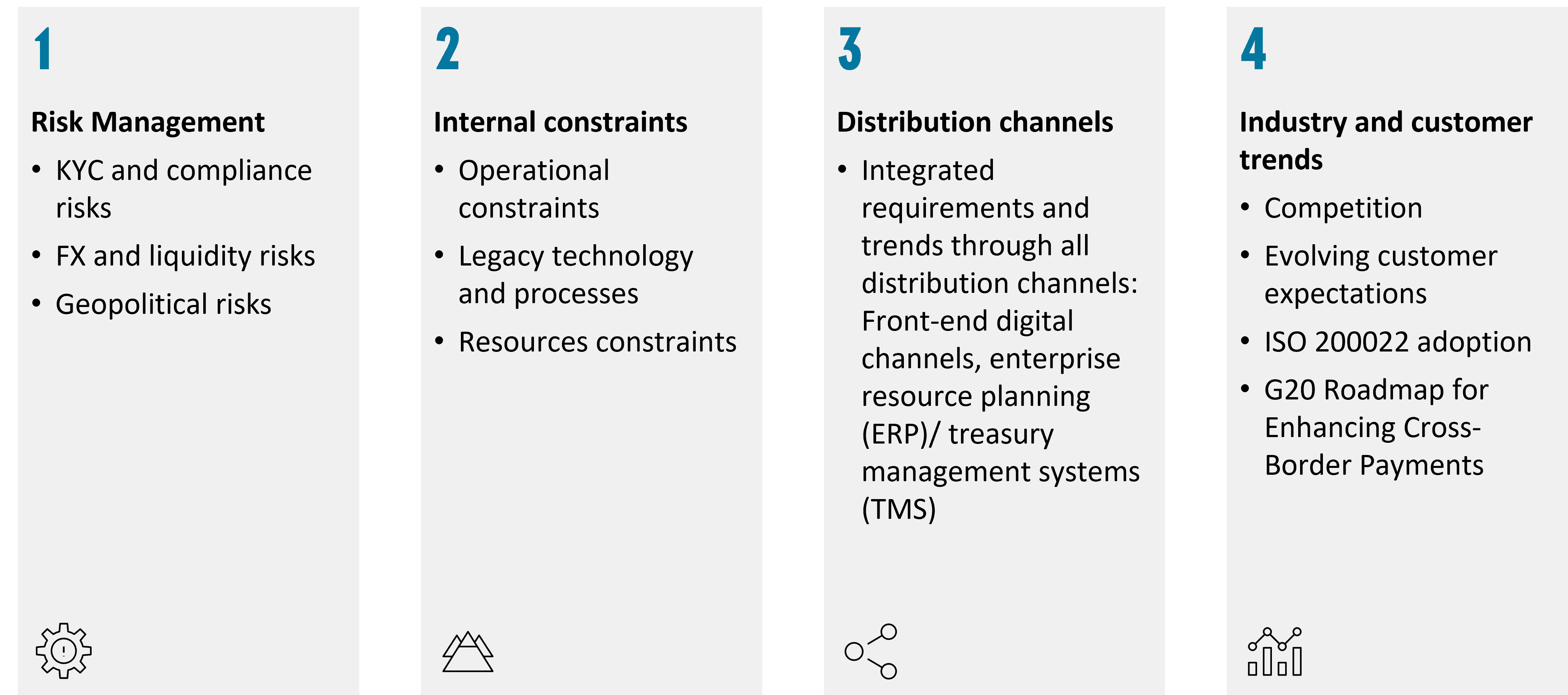

Strategically, these payments enhance operational efficiency and facilitate international trade, presenting financial institutions with opportunities to expand revenue through integrated B2B payment solutions. However, challenges such as regulatory complexities, currency fluctuations, and the demand for transaction transparency require robust risk management and compliance strategies.

Figure: B2B Cross-Border Payments Challenges

Looking ahead, the B2B cross-border payments sector must embrace innovative technologies and foster strategic partnerships. By leveraging advancements like artificial intelligence and blockchain, businesses can improve transaction efficiency and security. Collaboration between established institutions and fintech innovators is vital for creating a more robust payment infrastructure.

As the landscape evolves, stakeholders must align with technological advancements and global commerce trends to optimize efficiencies and reduce barriers. This research provides a foundation for understanding the opportunities within B2B cross-border payments, equipping stakeholders to meet future demands and drive business success.