Download your free sample here:

The wealth management industry will face headwinds in 2021 as the effects of the COVID-19 pandemic continue to ripple through society. Celent foresees a year in which financial institutions and vendors strive to innovate outdated systems while controlling spending. Against the backdrop of COVID-19, the broadening of the wealth management client base, disintermediation of distribution models, and subsequent democratization of wealth management will play a significant role in altering the traditional operating model and make 2021 a pivotal year of innovation for wealth managers.

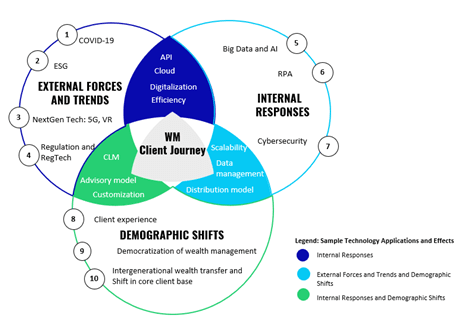

Celent identifies 10 interconnected trends affecting the wealth management industry in 2021. These trends are grouped into three broad categories: external forces and trends, internal responses, and demographic shifts. The overarching theme of 2021 is the Wealth Management Client Journey.

Whether or not 2021 brings a return to normalcy, wealth managers should build on their hard-fought gains from this year and refocus on the secular trends that are inexorably changing the core of the industry.