The last 18 months have been like no other in recent memory. The COVID-19 pandemic forced everyone, not just those in financial services, to react at speed and reconsider their priorities. Despite one of the steepest drops in gross domestic product (GDP) ever experienced, the global banking system has proven resilient. Capital levels built up after the financial crisis have proven sufficient, while unprecedented levels of government support have blunted or deferred many of the pandemic’s economic impacts. However, bank revenues and asset bases have of course been hit.

Retail banks have an unprecedented opportunity. By supporting the recovery from the pandemic and helping to tackle some of the big issues facing economies, the sector can gain a strong sense of purpose, grow the bottom line, and ensure its ongoing relevance. But to deliver this change, banks need a new mindset and capabilities, not the least in technology. While there’s much uncertainty remaining in 2021, retail banking technology priorities for 2022 and beyond are becoming clear.

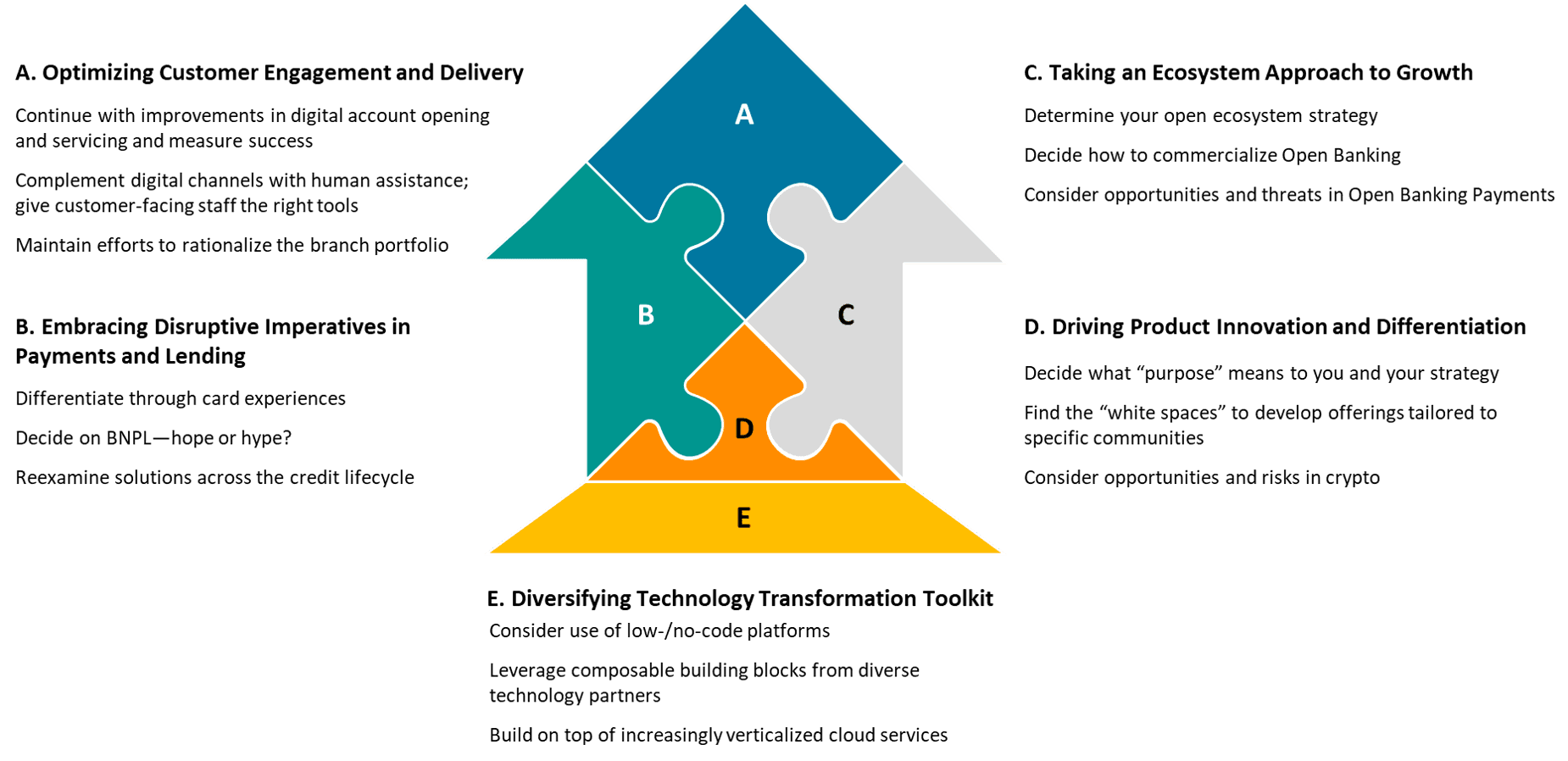

This report summarizes Celent’s guidance to clients around five key industry themes and 15 retail banking technology priorities for 2022. The report is part of Celent's new Previsory (Pre-view and ad-visory) series, a forward-looking view of financial technology trends across our industry verticals and advice on how to respond to them.

The five themes are consistent across Retail and Corporate banking and will guide our research agenda for 2022. The report draws on some our recently published insights, but much of the content is new, published here for the first time.