Recent advances in artificial intelligence and robotic process automation tools offer opportunities for drastic improvements in costs and efficiencies. They also allow banks to take a more entity-based approach and conduct holistic analysis.

This report discusses latest developments in technology solutions used for fighting financial crime, specifically in watchlist filtering and transaction monitoring. It identifies key requirements of banks and other financial institutions, especially in light of regulatory evolution, and offers solutions that can best meet the needs by highlighting emerging use cases and initiatives.

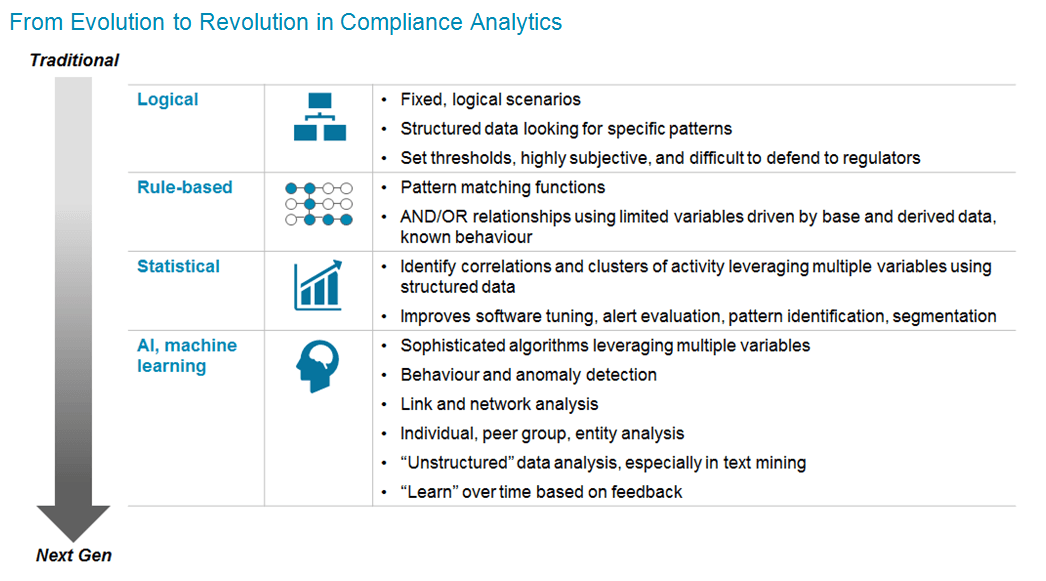

Risk and compliance has emerged to be one of the most important areas in financial services as regulatory and political authorities in the last decade increasingly focus on mitigating risks to improve transparency, safety, and stability of markets. As a result, the scope of financial crime compliance is expanding. There are many deficiencies with the way banks traditionally approached compliance operations. AML technology greatly relies on rules-based analysis, which is subjective, predefined, and highly static, requiring major effort to update. The result is a high number of false positives, managing which is one of the biggest challenges.