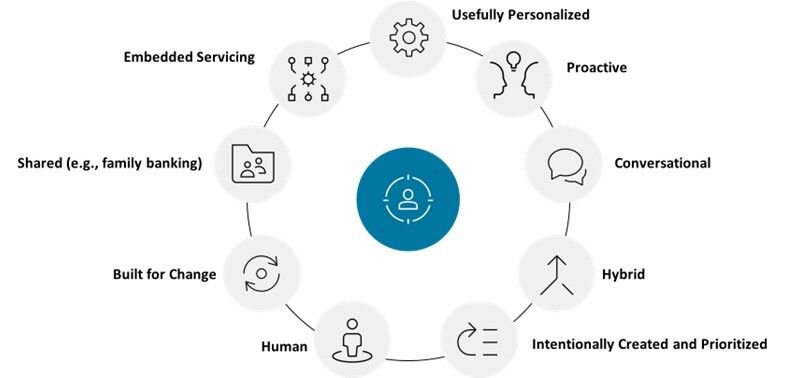

To help financial institutions put the insights conveyed in our previous report into action, we profile four engagement banking initiatives among three EMEA pacesetter banks through the lens of Celent’s nine hallmarks of engagement banking.

All three are examples of intelligentvirtual assistant implementations.

- Built for Change: A Portuguese Bank's Virtual Assistant

- Conversational: Alior Bank InfoNina

- Intentionally Created and Prioritized: Nedbank Enbi Virtual Assistant

Although there are common elements among engagement banking pacesetters, there is also great diversity in approach and outcome.