Core banking system technology has changed more in the last 5 years than it had in the previous 20. Market dynamics are shifting as new core system vendors are coming to market with systems that fully embrace cloud-native development and modern technology. These upstarts promise to provide more system choices for financial institutions and radically reshape the core banking systems market across the globe. The core platform providers analyzed in this report are: 10x, FIS, Finxact, Five Degrees, Mambu, Ophen, Pismo, Technisys, and Thought Machine.

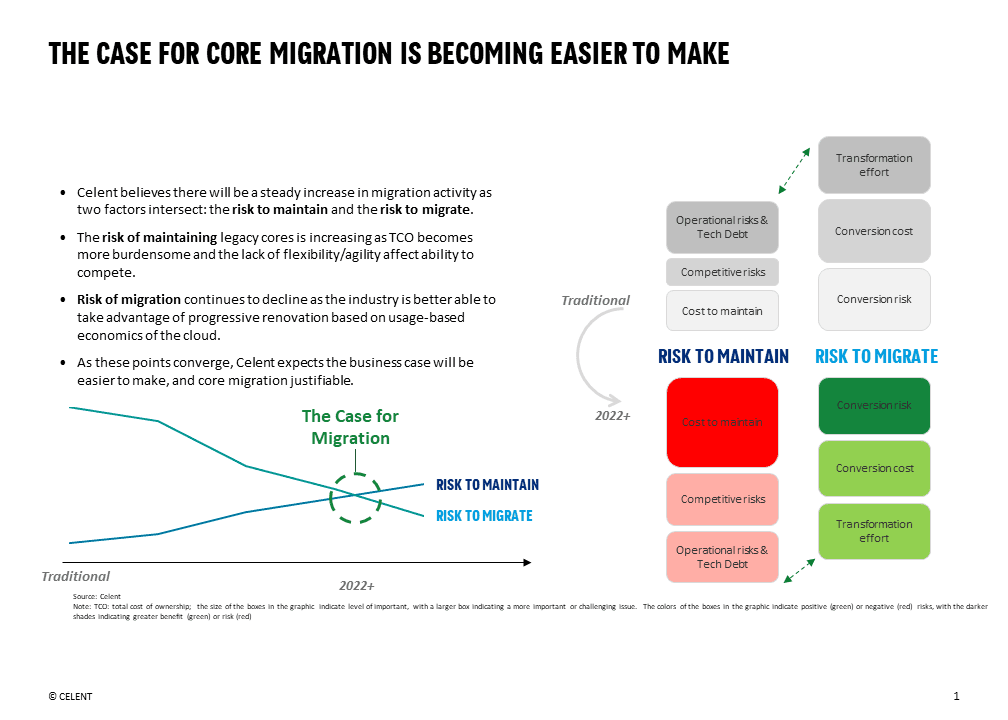

Financial institutions are rethinking the traditional calculus and cost/benefit of core system migration, looking at new methods for migration which make core modernization more feasible. The demands of digital banking are pushing more institutions to kick the tires on legacy platforms and begin exploring new options.

The analysis in this report:

- Explores the market drivers that drove the creation of next-gen core vendors.

- Provides an in-depth view of cloud-native system architectures and go-to-market strategies.

- Illuminates many of the differences between next gen core vendors and versus incumbent core system vendors.

- Highlights the features and capabilities which make them differentiating.

NOTE: This report is separate from Celent’s core platform ABC report, which analyses incumbent core banking systems using Celent’s proprietary ABC scoring methodology. This report analysis makes no definitive comparative statements about which platform is more fit for a particular financial institution.