Application programming interface (API) has been the go-to solution when insurers and technology vendors discuss the way to develop, package, and ship function in a scalable modular manner. Going forward, the next-generation insurer will require capabilities to integrate legacy functions with modern technologies such as AI/ML functions for customer onboarding or predictive analytics.

This raise the following questions that we will address in this report:

1. What are the API business models observed in recent implementations or discussions?

2. How can participants in the insurance ecosystem benefit and design their strategy to benefit the most from the API model?

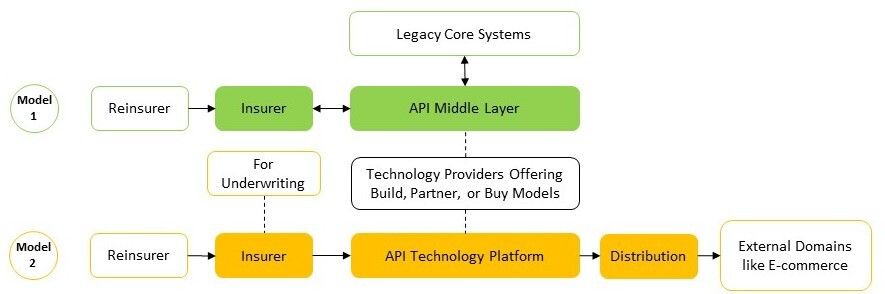

In this report, we will examine the common API model in today's insurance technology stack. We will understand from insurtechs' and technology vendors' approaches to modernizing legacy infrastructure with modern functionalities or offering new insurance distribution model. This will lead to a discussion about API factory versus embedded insurance. Read on to discover how we identify and illustrate the below two models of providing API services for the insurance ecosystem.