The emergence of insurtechs in the 2010–2015 period marked a new stage in the evolution of MGAs. The value propositions of many insurtechs centered on their ability to develop, price, and underwrite products more effectively than incumbent insurers.

This report contains profiles of five MGAs whose business models are based on their ability to leverage technology for competitive advantage:

- Arden Insurance Services: Arden focuses on only one market: residential condominium associations. One of Arden’s value propositions is its complete focus on that sector, which allows it to understand that sector’s range of risks better than its competitors.

- Embroker describes itself as “radically simple destination for industry-tailored commercial insurance.” Embroker’s platform, Embroker ONE, is a single-application process that allows a user to, in a single session, get all of the policies it needs. The platform leverages Embroker’s partner relationships, rating engine, and artificial intelligence.

- Falcon Risk Services: Since beginning operation in 2021, Falcon has built its own technology platform and infrastructure. A key value proposition is Falcon’s ability to leverage its data platform to inform pricing, underwriting, claims processing, and strategic management analytics and decision-making.

- kWh Analytics offers property Insurance, focusing on solar, wind, and battery energy storage projects. kWh Analytics’ value propositions rest on its ability to apply the data, knowledge, and expertise it acquired analyzing potential losses for lenders and investors to the adjacent risk assessment and loss development model requirements of insurers.

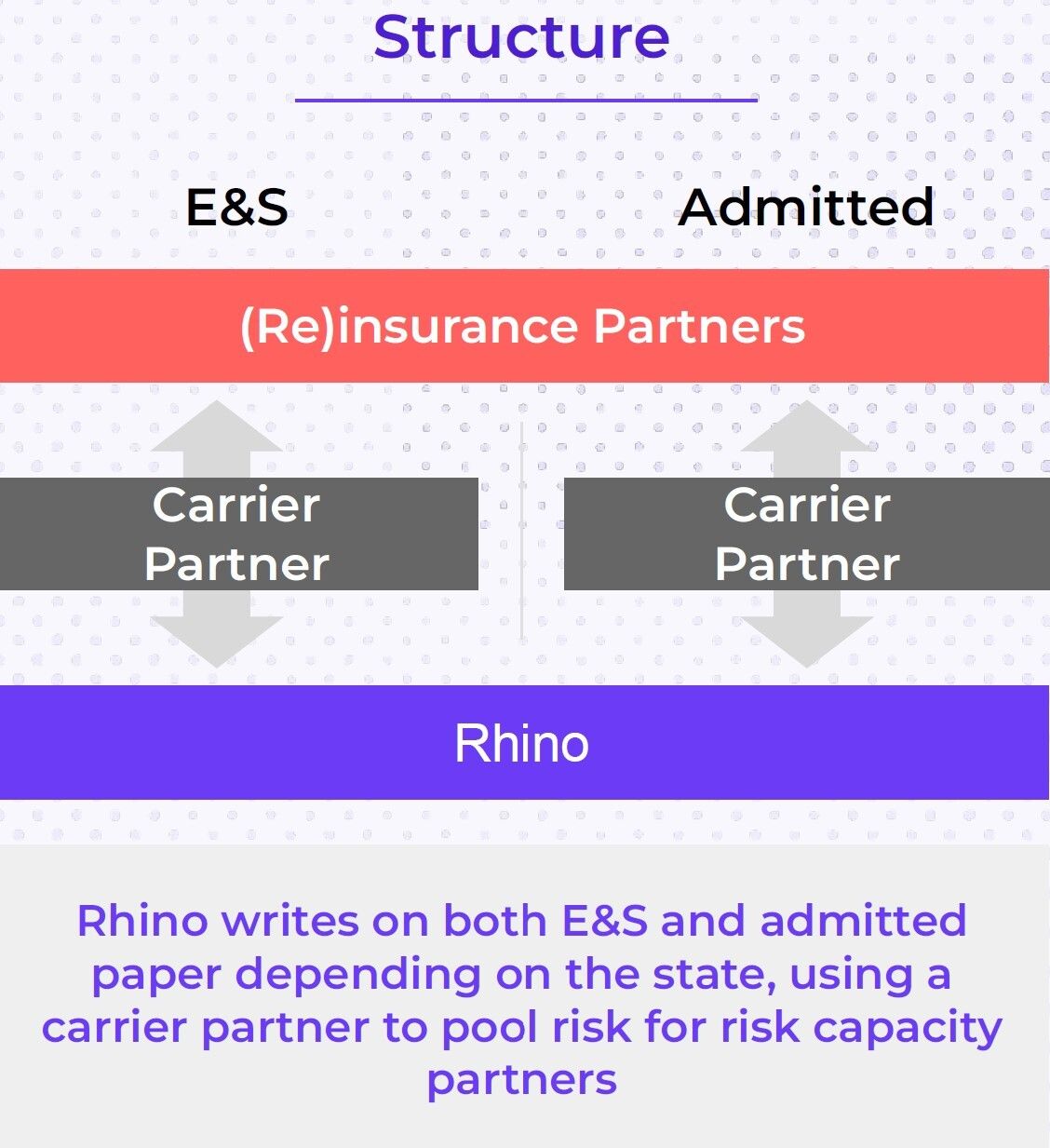

- Rhino offers security deposit insurance to new tenants of large rental property owners. One of Rhino’s key value propositions is implementing a Rhino-specific renter facing experience, which is natively embedded within the property leasing process, and making real time accurate pricing and underwriting decisions. Rhino is a distribution partner for both E&S and admitted insurers.

Source: Rhino