Analyst Perspective: While it is important that insurers are curious about new data gathering options and emerging technologies such as robo advisors, chat bots, artificial intelligence, and others, we think they should not rush to implement these new technologies. On the other hand, we think that it is crucial they try to anticipate how these technologies might impact their traditional model and identify the value they can generate not only for their customers but also for their core business (underwriting results).

Celent has released a new report titled Meeting European Consumer Digital Expecations: Considerations for Insurers. The report was written by Nicolas Michellod, a Senior Analyst with Celent's Insurance practice.

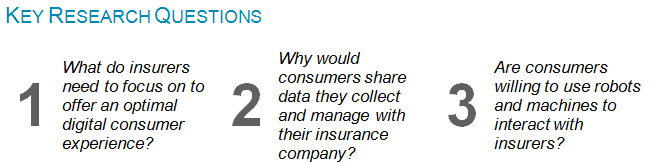

Celent surveyed consumers to understand their expectations about their digital interactions with insurers, their willingness to share data with them and also their level of adoption of smart technologies. This report details the finding of this survey with focus on Europe.

European consumers have high expectations for digital interactions, and the most digital savvy are clamouring to see insurers provide more intuitive self-service interactions going forward.

European consumers do not want to waste their time when looking for information and require instant understanding of the interaction interface offered by insurers. The main reason for sharing data with insurers is to obtain a premium discount. European consumers have a high appetite and curiosity for bots and robo advice. and insurers should grasp the opportunity to investigate how they can invest in these technologies to generate higher value in customer interactions.

“The growing demand from consumers, the need to collect new types of data to satisfy this demand. and the emergence of new technologies in relation to customer interactions allowing for more automation and intuitive communication force insurers to adapt their customers’ touch-points,” Michellod commented.

“We think insurers need to consider new approaches to collect consumer and customer data and use smart technologies to improve the way they digitally communicate,” he added.