In Q4’s research agenda I referenced quotes from CEO’s of JPMorgan and Goldman Sachs making reference to the difficult market conditions, but although in “early innings” they implied the direction of travel is constructive. They called that right. Growth has held and the industry has decided it’s time to play ball (although risk appetite varies across institutional and retail traders).

By the end of September M&A transaction value exceeded $10bn, there was record corporate bond refinancing and we are seeing a banner year shaping up for mega dals. Investment bank revenues are looking strong, in some cases, like for Jefferies, returning record quarters.

On the trading side, macro events fuel volatility resulting in record levels of trading revenue in many cases. Asset management and securities servicing arms of banks continue to perform nicely as well.

One specific challenge to the sell side can be found in the the rise of nonbank liquidity providers, with their high tech-focus on electronic trading, continue to challenge banks in the Global Markets space. Jane Street’s Q2 revenues of $15.5bn topped JPM’s trading revenues that quarter and collectively the top three nonbank liquidity providers collected about $30bn in trading revenue in H1 versus $48bn for top three Investment Bank Global Markets players, GS, JPM, MS.

While revenues by nonbanks LPs are lower collectively, margins are way higher, for example Jane Street’s 48% versus GS’s 26% or Barclays 9% - which shows the capital and technology constraints the banks are working under.

Senior executives and their technology teams at leading investment banks remain optimistic on the sell side. Jefferies’ CEO summed up the view in their 3Q earnings call, “While the world remains volatile and full of challenges, we are increasingly optimistic about the near and long-term outlook for Jefferies.”

And the investment management community have also had quite a year, from AI-related impacts to tariff shocks to trade wars to global conflicts, it’s “interesting times” as they say. Through overall AUM continues to grow, so does downward fee pressures, spurring industry consolidation. The buy side is looking to scale up as industry leaders continue to increase market share. Leading asset managers will have to leverage technology for enhanced insights and new revenue sources, as well as efficiency across both distribution and operations.

With the economic paradigm shifting from globalization to modern mercantilism, geopolitical tensions rising, and sustained competition from non-banks and fintechs, major investor assumptions are being challenged. Questions remain whether AI’s impact will shift from capex spend to productivity growth in 2026. The US has been the decades-long leader in terms of both investable assets and wholesale banking revenues, but shifts present new opportunities and challenges for all. And while trade wars and tariffs grab attention, the battle over capital may be the one to watch, whether stablecoin adoption or hard assets, with the prize being control of the global financial system. Leveraging those opportunities requires having the right technology strategy. Celent is here to help.

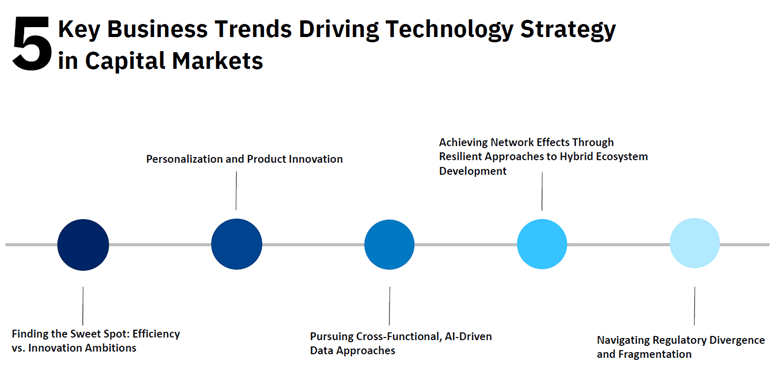

At the end of each year, Celent identifies the key business trends driving technology investment across capital markets, and we’ve recently released our 2026 version.

These themes also guide our research agenda throughout this year. Ever-evolving, each year the differences, however nuanced, become clear when evaluated in conjunction with specific market structures, regulatory trends, and emerging technologies on both the buy and sell sides.

In these challenging times, one thing is sure: none of us can go it alone. As you face hard decisions in the areas of technology and partnerships, Celent is here to support you. We can help you vet partners and technologies as you respond to competitive, market, and regulatory initiatives, as well as the changing needs of your customers and growing cost pressures.

As always, we’ll look to be nimble and respond to fast-moving developments in our research space. If you have a topic in mind where our research could add value to your organization, please get in touch so we can discuss and consider incorporating it into our quarterly research agendas in the coming year.