Large US retail banks are realizing tech-driven efficiency gains, with more to come from AI.

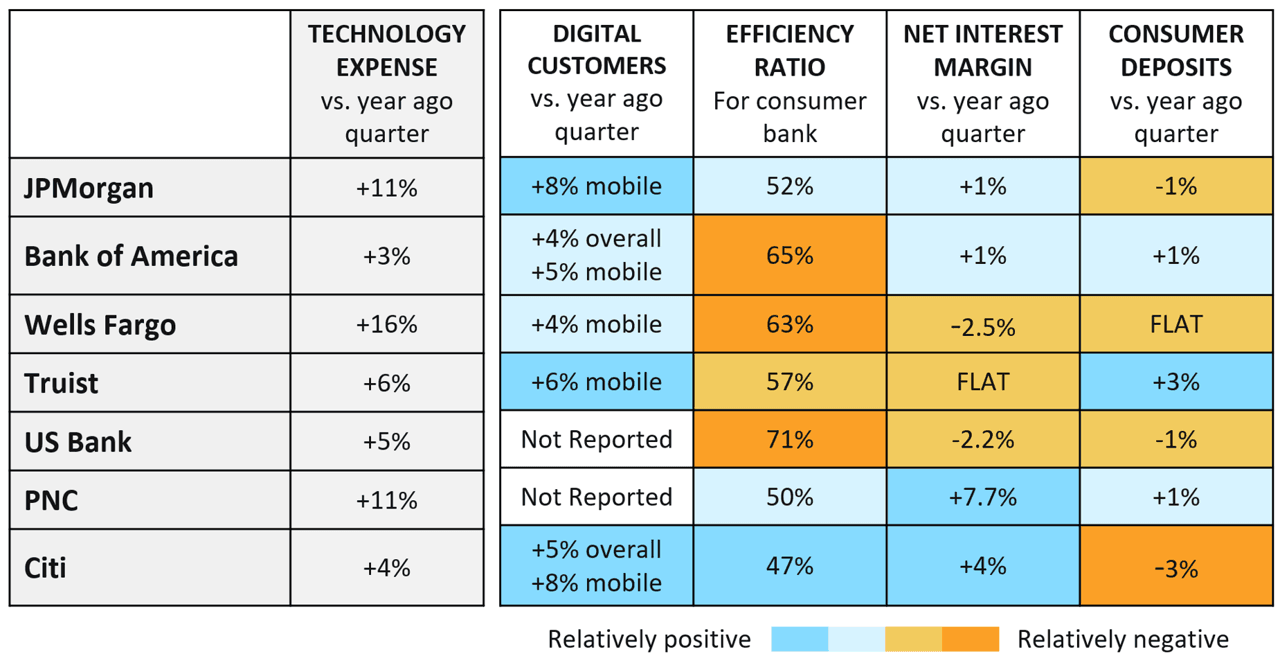

There were many positives for the largest US banks to report this summer. Sustained consumer strength, increased digital engagement, and in many cases, continued expense reductions, all led to generally strong earnings reports for the second quarter.

But challenges remain: Interest rates are still “high-ish” and in a holding pattern, putting pressure on deposit costs. The home lending market remains cool, limiting the ability to capitalize on widening net interest margins. With these factors providing constraints to top-line growth, expense efficiency has become a primary focus for most.

In this flash report, Celent evaluates the public presentations and earnings calls from seven of the largest US banks through three lenses:

- Balancing digital and human support

- Metrics for digital customer engagement

- Value of technology to the franchise

We find that most banks are seeking and achieving operational efficiencies through prior technology investments.