Banks still have a long way to go to unlock speed and agility.

In late summer of 2024, I published The Need for Speed! Accelerating Product Agility in Corporate Banking. The approach was to explore the technology funding allocated to “growth initiatives” and understand the barriers to innovation and enhancing products. In turn, I laid out some foundational steps that product managers can take with their technology counterparts to improve product agility.

For corporate banking units, achieving greater speed and agility in technology is required to accelerate product innovation and enhancement. The complexity of corporate banking products and the integration of multiple applications—along with the challenges of meeting compliance mandates—thwart many product innovations. As noted in The Need for Speed, in Celent’s 2024 Dimensions survey the most frequently top-ranked challenge was shortage of developer capacity and skills. The old way to address these challenges was to add more developer resources by spending more money and/or offshoring to lower-cost labor markets. Although that remains an option, this is also a path to diminishing returns as project dependencies increase and the propensity for development process collisions adds to delivery risk.

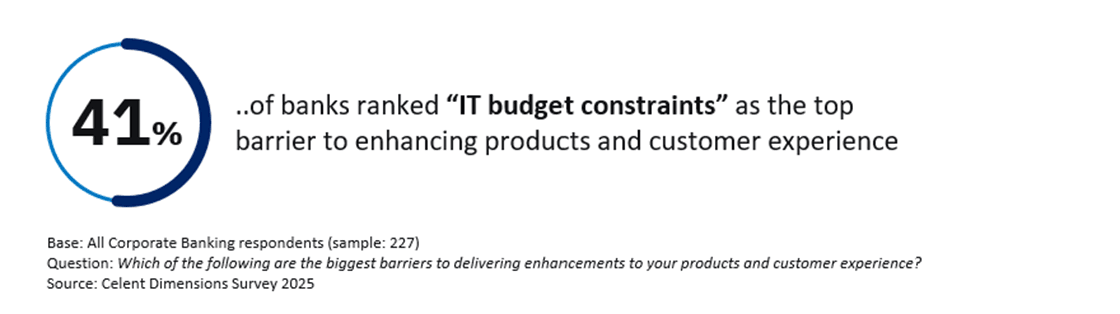

My colleague, Gareth Lodge and I recently published the annual Celent Dimensions: Corporate Banking IT Pressures & Priorities 2025 report for corporate banking. This year (2025) the most frequently #1-ranked driver of technology spend by banks worldwide is “enhancing the product proposition and innovation,” followed closely by “achieving greater speed and agility.” However, when Celent asked bankers about the biggest barriers to innovation and product enhancement, the top answer was IT budget constraints. How can this be? Even though product innovation is the top-ranked driver of technology spend, and although IT budgets are increasing by an average of almost 6% annually, product managers face intense competition for investment funds.

The reality is that competition for “growth” investments is extremely tight. Limitations of existing technology, and pressure to focus on mandatory/compliance changes were also highly-ranked barriers to innovation. After all, it is extremely expensive to run a bank these days, and most banks wrestle with a large portfolio of compliance projects. Meanwhile, innovation is hindered by aging technology.

Increasing speed and agility does not mean simply adopting agile development methodologies. Banks can also adopt technology accelerators such as next-generation banking platforms, low/no-code platforms, and GenAI to support developer productivity—all of which can help accelerate product development. Banks should also consider the importance of aligning to a modern architecture stack, designing for “cloud-first,” and embracing fintech partnership options to accelerate product development.

The winds propelling innovation forward may be favorable, but the sea remains choppy. The implication of the Celent Dimensions survey is that banks still have a long way to go to unlock speed and agility, even as GenAI and modern development platforms provide developer productivity improvements.

Dimensions: Corporate Banking IT Pressures & Priorities 2025

Transforming Digital Banking at Fifth Third Bank with AWS

Top Technology Trends Previsory: Corporate Banking, 2025 Edition

Technology Trends Previsory Webinar: Corporate Banking; 2025 Edition

The Need for Speed! Accelerating Product Agility in Corporate Banking