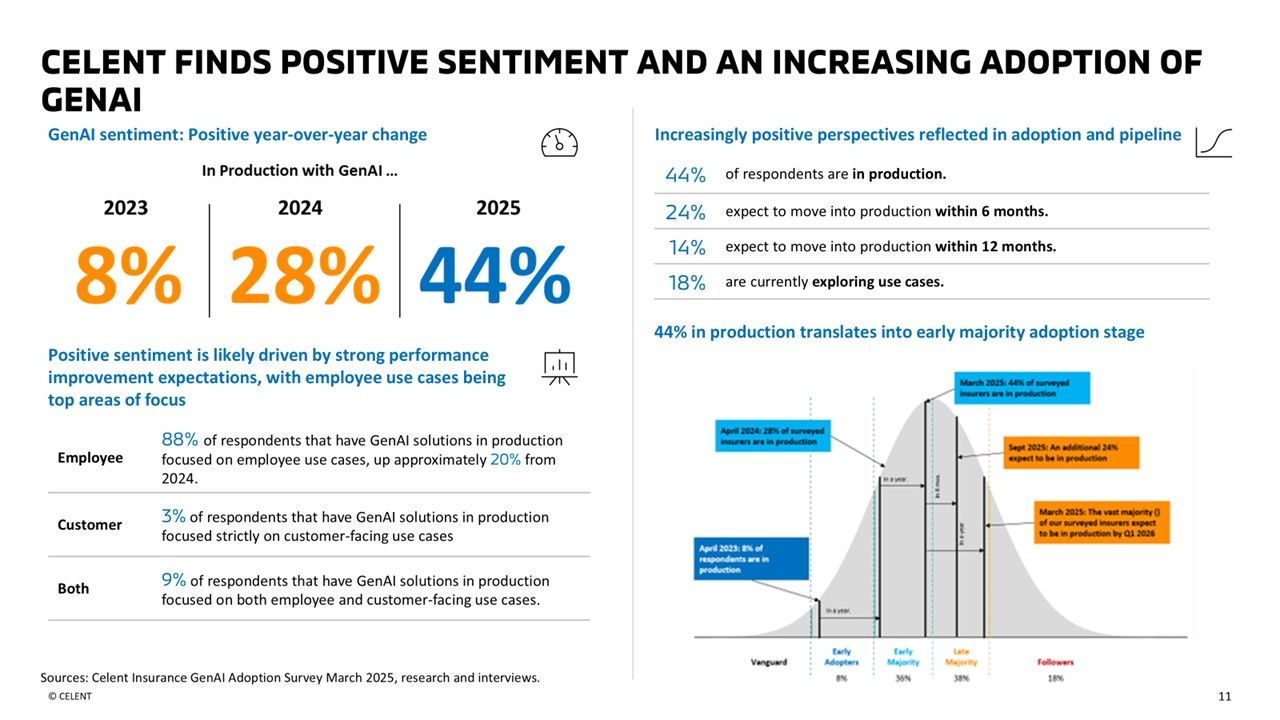

Celent recently published our 3rd Annual GenAI in Insurance reports for P&C and Life. They are based on data collected in March 2025 through our annual survey of North American insurers. The reports highlight that the insurance industry has been increasingly embracing GenAI solutions to enhance various aspects of its operations. In 2025 we witness another dramatic year-over-year increase (57% - see chart below) in the implementation of GenAI in production. Similar to 2024, key areas of GenAI integration have been in claim processing, underwriting, customer engagement, and, on the technology side of the house, code development. Another third of insurers surveyed have indicated they are in pilot programs or proof of concept to test GenAI applications, with a growing number transitioning to full-scale implementation as they validate results.

The speed at which GenAI is being adopted continues to amaze most that we have spoken with regarding GenAI over the last two years. Insurers are increasingly recognizing the potential of AI to transform their operations. There has been a notable increase in investments in AI technologies, with many companies allocating substantial budgets for AI initiatives.

The insurance industry is witnessing a swift and transformative adoption of GenAI. As technology continues to evolve, further integration of GneAI is expected, reshaping the future landscape of the insurance sector.

In addition to the data gathered through our GenAI survey, I recently attended an AWS analyst session in NYC. They had a number of organizations that came in to discuss their respective AI journeys. Principal and AIG were two insurers highlighted. Each had very positive outcomes and also a number of similarities from the standpoint of preparing for AI.

In both sessions, similarities highlighted:

- Strong leadership supporting their AI vision

- Company wide training for GenAI

- Significant efficiency gains

- Impactful customer experience improvements

- Mapping value creation to measure gains

Some unique actions:

- Developing an AI university program

- Creating an AI-lab for ideation and PoC

- Creating an AI CoE framework

- Piloting GenAI for propensity

- Mapping value creation to financial planning to measure gain and then hold business enitities accountable for value realization

- Constructing guardrials for the use of agentic AI

One big question that I have heard from many insurers was also echoed during one of the sessions, “GenAI is creating value, but how do you turn value creation into value realization?”

All indicators point to GenAI opening the door for insurers to achieve step change and even game-changing differentiation. Initially, differentiation has been “behind the scenes” in employee-facing use cases. GenAI is proving that it can reduce operating costs and improve productivity, which frees up resources to focus more on value-adding activities and innovation. In addition, Celent anticipates that GenAI will help insurers accelerate to the cloud and modernize their data infrastructure, enabling them to become more data-driven and make faster, smarter decisions.