The Instant Payments Regulation (IPR) mandating immediate payments for euro-denominated credit transfers is a watershed moment for Europe’s payments market, moving instant transfers from a niche offering to a mainstream expectation. By 2035, Celent anticipates that SEPA Instant Payments (SCT Inst) will be deeply ingrained in European commerce, effectively the “new normal” for electronic payments.

Celent kicked off this research study seeking to better understand how various players—banks, electronic money institutions (EMIs), and payment institutions (PIs)—are getting ready to capture the SCT Inst opportunity:

- Market Readiness and Compliance: How ready are the different institutions to comply with various SCT Inst mandates? What approaches are they following, how much are they investing? What challenges are they facing? What actions do they expect from the regulator?

- Attitudes to SCT Inst: What does the industry expect from SCT Inst? How are the industry players engaging with customers? What factors/ use cases do they see as the key drivers of SCT Ins adoption? What SCT Inst adoption do they expect at their institution/ country/ eurozone/ EU? Will that meet the regulator’s expectations?

- Resulting SCT Inst Volumes: What does that mean for SCT Inst volumes? What proportion of traditional credit transfers (SCT) will become instant? Will SCT Inst take market share away from other payment types? What other market developments might impact SCT Inst?

To capture the industry's sentiments directly, Celent surveyed over 100 financial institutions: retail and corporate banks, EMIs, and PIs, operating across 10 European markets. In addition, Celent developed a model forecasting SCT Inst volumes, based on our understanding of market developments and drivers, payment volume data available from GlobalData and other sources, as well as the survey inputs. The research study that underpins the findings discussed in this report was commissioned by ClearBank, but the report was written independently by Celent.

Example research findings include:

- Banks are firmly on track to comply with the different SCT Inst mandates. All 60 bank respondents stated that they were already fully compliant with January 2025 requirements and over half (55%) are already compliant even with July 2027 mandates.

- The industry’s attitudes to SCT Inst are overwhelmingly positive. The survey respondents believe that SCT Inst will have a positive impact on the industry overall (73% agreeing), benefitting not only their customers (69%) but their institutions as well (65%).

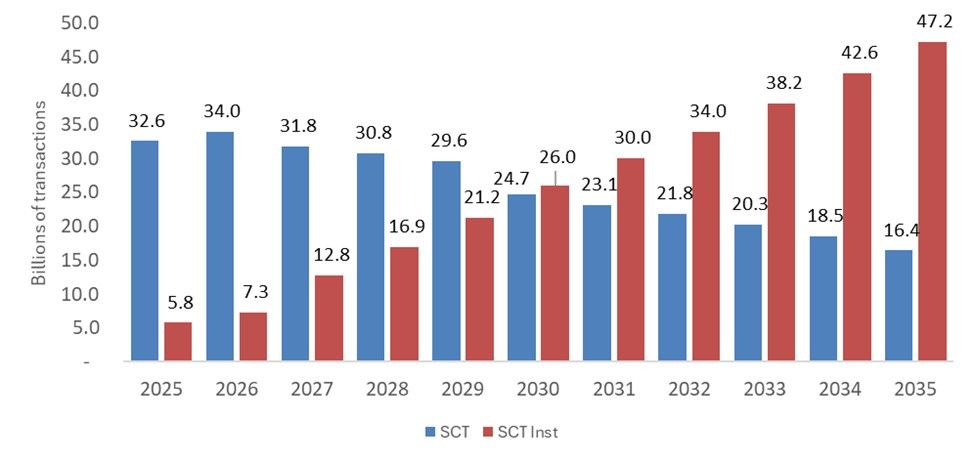

- By 2035, most credit transfers will be instant: every institution expects that at least two-thirds of SCT volumes will become SCT Inst, with an average of 75% of all SCT volumes.

- Celent forecasts that SCT Inst volumes will overtake SCT by 2030 and will accelerate away. SCT Inst is poised to capture a growing share of a growing payments pie and by 2035 will become the second most used non-cash payment type, representing 18% of all payments.

- ... and many more.

The move to instant payments in Europe is accelerating a broader transformation towards real-time, intelligent banking. Compliance with IPR is merely the first step. The real winners will be institutions that go beyond compliance and innovate on top of instant payments, creating seamless, secure, and intelligent payment experiences, where money moves as fast as information, and banking truly happens in an instant.