To counter the increasingly sophisticated and technology-enabled fraud targeting the financial services industry, financial institutions and their technology partners are developing ever-more advanced solutions to detect and prevent fraudulent activity, including techniques that leverage multiple predictive deep learning and generative AI models. However, advanced anti-fraud models typically run on peripheral hardware separated from the transactions and data, creating a “last mile” challenge in deploying AI models at scale for large institutions that run mission critical transactions on mainframe computers. In addition, the need for more processing power and technology resources continues to grow as the models become larger and more complex.

IBM helped overcome this barrier with the release of its Telum processor for the IBM z16 mainframe in 2022, which incorporates an AI accelerator to support AI inferencing directly in the mainframe environment. This breakthrough enabled even the largest banks to run complex anti-fraud models against all transactions in real time, and without the latency and throughput issues that can be caused by sending core transactions off the mainframe to peripheral fraud systems.

IBM is now releasing second-generation AI accelerators as part of its new z17 system. The new accelerators are significantly more powerful, providing enough compute to run multiple AI models simultaneously. The accelerators are also tuned to run large language models (LLMs), again directly in the mainframe environment. Celent believes that LLMs and other transformer models will become integral tools for transaction fraud detection and the ability to run these models in real-time production environments will be increasingly relevant to anti-fraud efforts in banking, cards and payments.

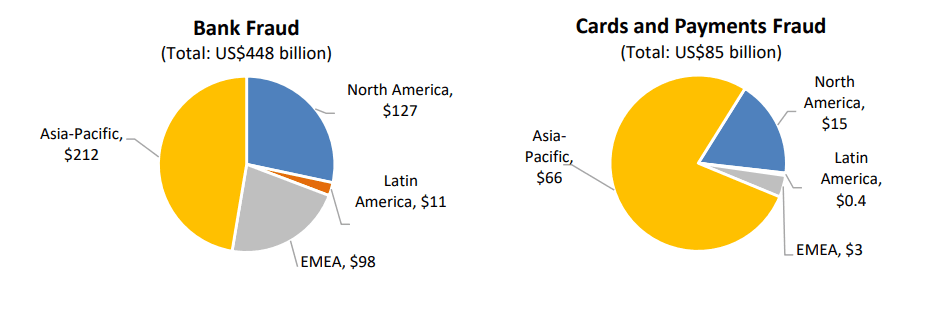

Celent estimates that if, theoretically, all banking, cards and payments institutions running on Z mainframes were to use this capability to run advanced anti-fraud models—including LLMs—on all their transactions, not just a sample, this could potentially reduce annual fraud losses by US$190 billion globally. For a typical Tier 1 bank, this translates into US$208 million in additional captured fraud annually, and US$35 million for a Tier 2 bank. Celent further estimates that insurers running on Z could capture an additional US$83 billion in fraud compared to current detection techniques.

Source: Celent estimates

Source: Celent estimates