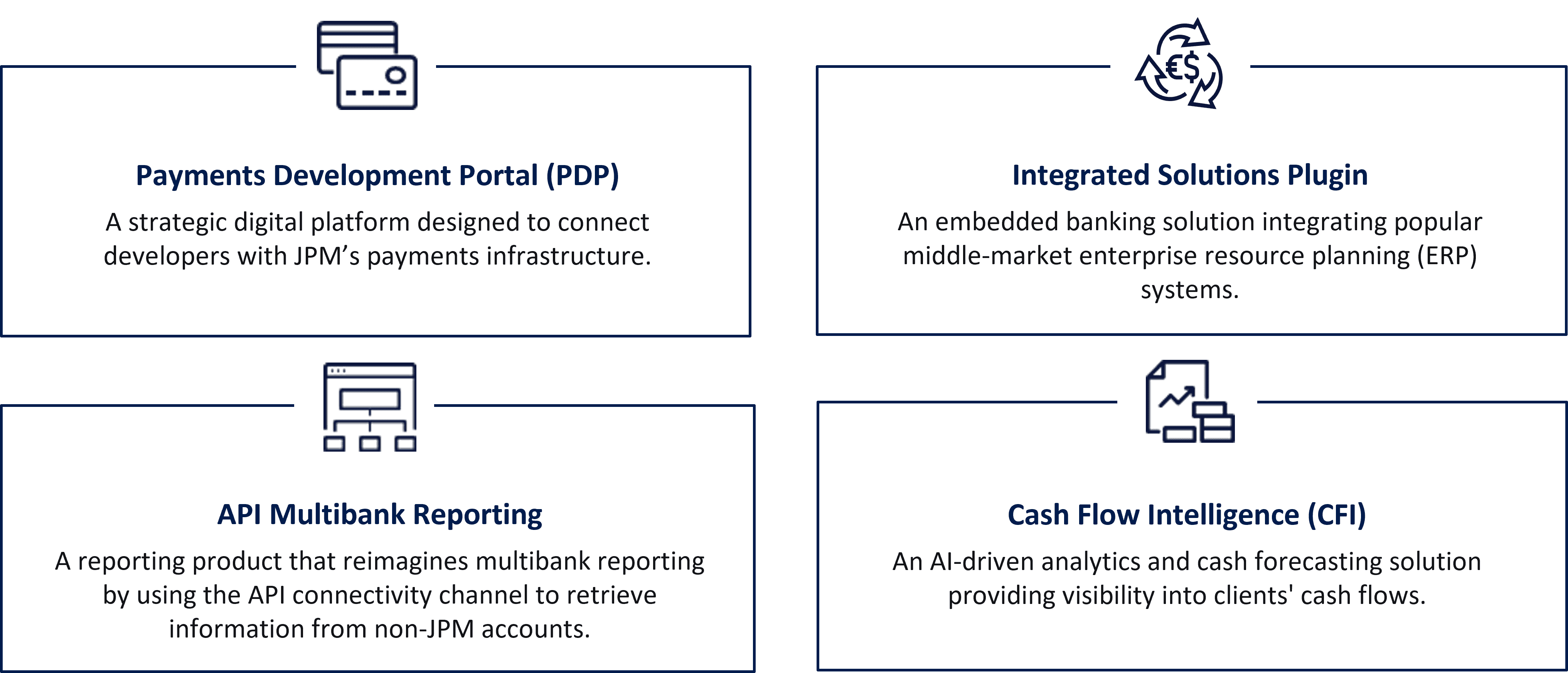

J.P. Morgan is one of the world’s largest data- and tech-driven firms, investing $17 billion annually in technology and operating at unmatched global scale and speed. Its Payments Solutions group is among the world’s largest, offering a digital-first suite of tools designed to help clients navigate risk, drive growth, and deliver superior experiences. J.P. Morgan Payments launched multiple initiatives in response to growing demand for integrated, sophisticated services—significantly enhancing its end-to-end payments and treasury capabilities and delivering measurable value to corporate clients and partners.

Each initiative featured in this case study is impactful on its own, but together they underscore J.P. Morgan’s commitment to supporting modern treasury operations.

The bank is positioning itself not just as a financial institution, but as a strategic technology partner in clients’ digital transformations—earning Celent’s 2025 Model Bank of the Year award.

Anyone can view a one-page summary of the report or watch a highlight reel of the case study to learn more. Additionally, you can watch an interview with J.P. Morgan's Lisa Davis, Managing Director, Head of Digital and Design Commercialization, for a deeper dive into the iniative and the team behind its success.

Celent subscribers can access the full length case study report below.