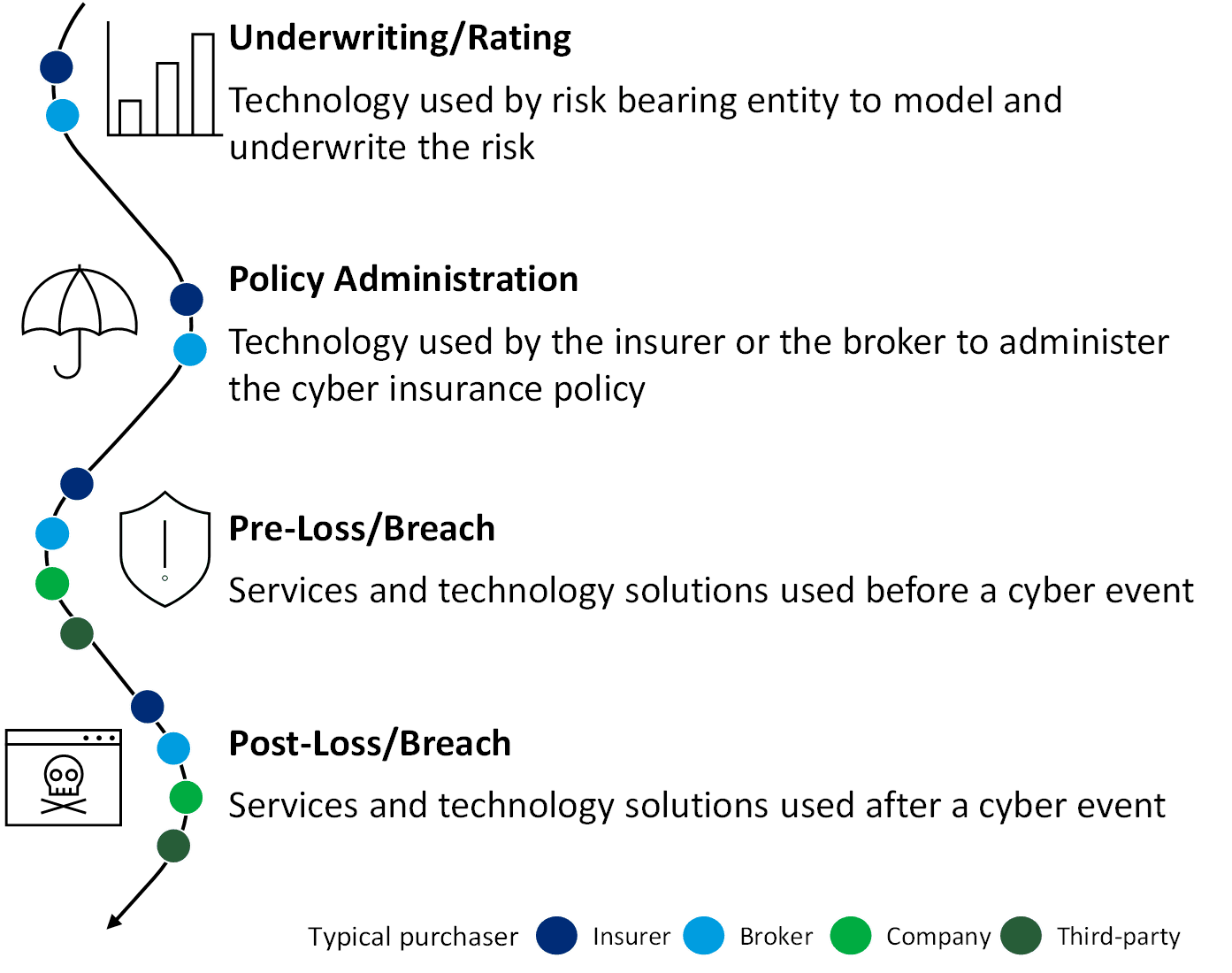

Cybersecurity risk management is made up of a vast array of technology and services. An insurer offering cyber insurance must underwrite and then administer the product; both functions require one or more technology solutions. They may also offer services to augment the insurance, which may be provided by a third party. Businesses may opt to buy these additional services and technology on their own, but in either case they need to think of cyber insurance from an ecosystem perspective.

Cyber Insurance Technology Ecosystem

Quantifying cyber risks is a challenge as threats become more sophisticated. This has become a problem for many industries; and cyber insurers are continually adapting to keep pace with new and emerging threats. Cowbell, a leading provider of cyber insurance for SMEs and middle market businesses, has implemented Cowbell Factors™, a rating index that that helps quantify subjective cyber risks and benchmark organizations against industry-specific aggregates across eight dimensions: network security, cloud security, endpoint security, dark intelligence, funds transfer, cyber extortion, compliance, and supply chain. With these factors, Cowbell is able to automate and accelerate underwriting.

Cowbell, with its cyber risk’s factors, represents a great example of how technology and specific datasets can help automate and improve cyber risk underwriting.

Please check out a highlight reel of Cowbell's initiative, along with a one page summary Celent subscribers can login to access the full length case study report.