The banking credit risk management apparatus has changed dramatically since the financial crisis of 2008. Many banks, savings and loan companies, credit unions, and other financial institutions (FIs) have since made significant investments in credit risk management technologies in an effort to prevent history from repeating itself. Although FIs continue to stress-test their loan and investment portfolios as they combat credit risk during the COVID-19 pandemic, in 2022 rising debt, inflation, and global economic uncertainty will require them to again reassess their credit risk management policies, processes, technology, data, and analytics.

This report assesses how credit risk officers (CROs), chief information officers (CIOs), and others responsible for the credit risk management function can shore up their defensive line to withstand high-risk macroeconomic, regulatory, and enterprise-level credit events. This report also covers new credit risk management technologies that can strengthen a bank’s offensive line, empowering it to outpace competitors and increase long-term profitability.

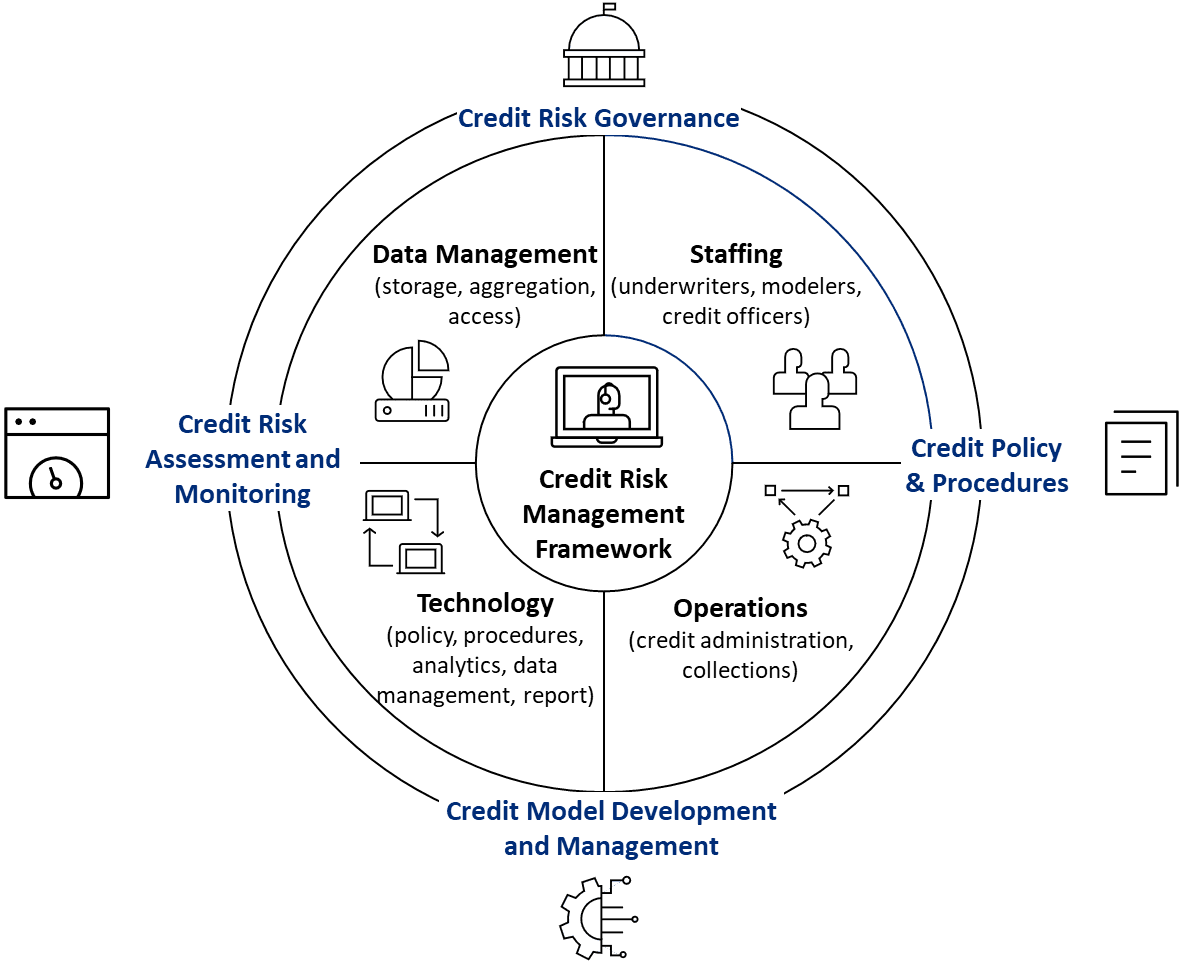

Credit Risk Management Framework, Resources, and Processes