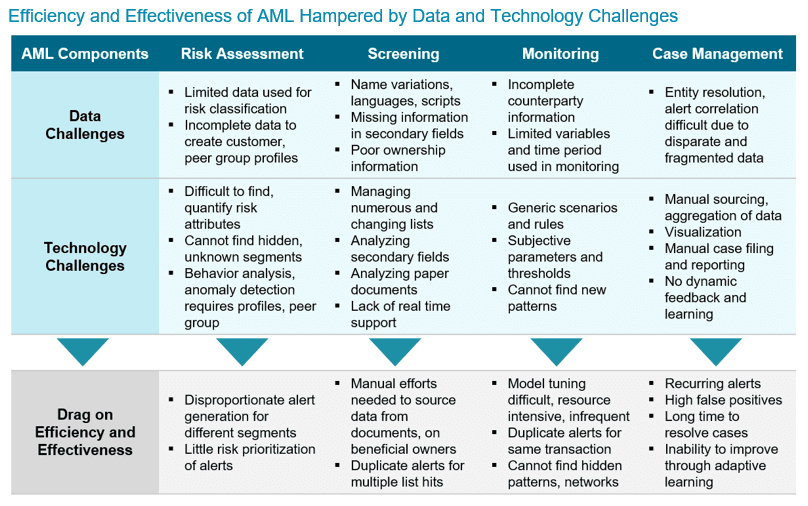

Intense regulatory scrutiny is exposing gaps in financial crime compliance operations, while proliferation of digital solutions and channels is causing rapid increases in volume and velocity of transactions. Traditional tools are insufficient to deal with the growing volumes and complexities.

Siloed operations, suboptimal data management practices, and rules-based technology fall short of optimally monitoring risks, making compliance programs inefficient and ineffective. Heavy reliance on manual efforts is rapidly escalating costs, making current practices unsustainable.