AI will transform the UI and in turn customer engagement. To track the progress in banking, Celent launched its inaugural AI in the UI Request for Information, which benchmarks current and future adoption, the prime use cases, and the underlying business cases.

Based on our findings, we will publish two series of reports, one covering commercial banking and the other covering retail banking. This report is the first in the retail banking series and shares key takeaways from the RFI. The next report will review vendors offering front office AI applications. The third report will cover pacesetter banks.

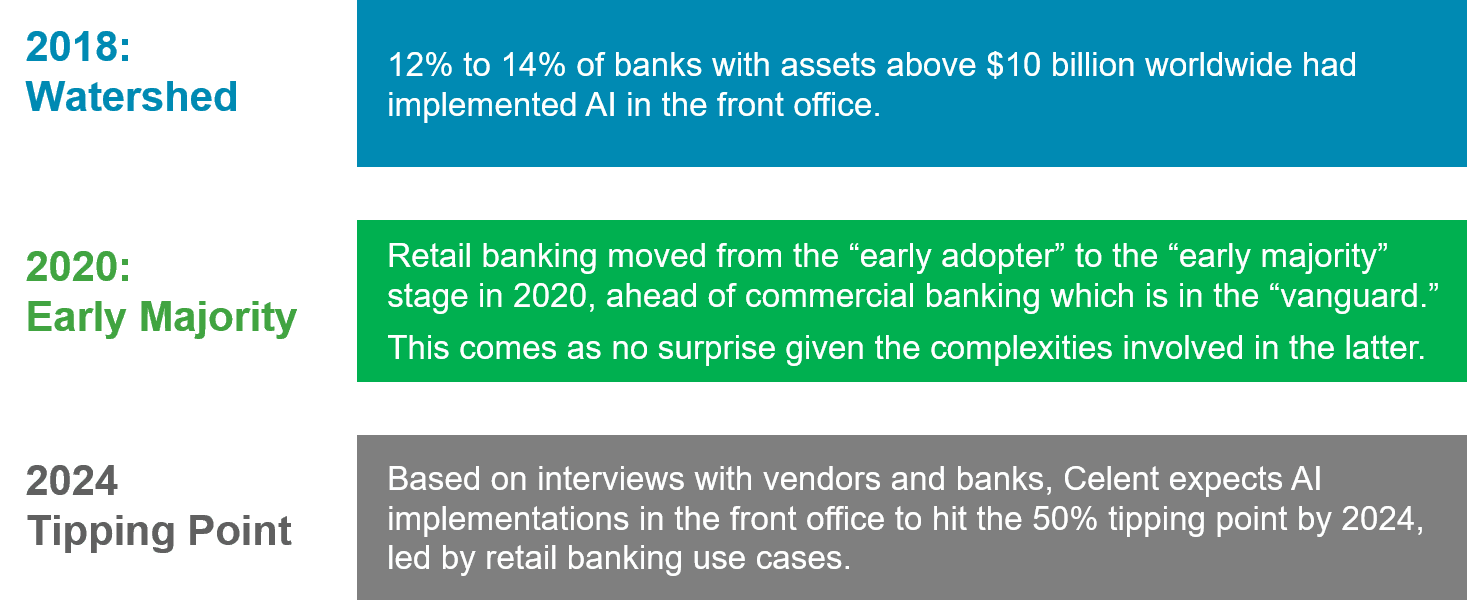

Based on the RFIs completed by 24 leading AI solution providers worldwide in 2019, another 16 in 2020, and research on banks’ in-house AI development, Celent estimates that 28% of global financial institutions with assets greater than $10 billion have live applications of front office AI. This compares to 24% in 2019, suggesting a robust 16% CAGR.

To cut through the buzz surrounding AI in banking, we analyzed use cases and business cases. We found a majority of total use cases supported by vendors in production are direct-to-customer in the digital channels (67%). We had similar findings for proprietary solutions based on conversations with vanguard banks. In corporate banking, customer-facing use cases hold a slight majority (54%). These findings are not surprising given the relative complexity of implementing customer-facing AI in corporate banking. While use cases are primarily basic customer support related (e.g., “tell me”) more advanced use cases are increasingly being launched (e.g., “advise me”). It follows that the primary business case is cost savings. Improving customer engagement, however, is increasingly a goal, particularly among banks that have already captured promised cost savings.