Three challenges are complicating digital channel leadership and technology strategy in retail banking today. Digital leaders can overcome these challenges with specific pragmatic approaches to better align their organizations, measure more value for customers and for the bank, and compete more effectively in a fast-changing market for consumer and business banking services.

In this new report, the three challenges are explored, and approaches are offered for digital leaders to begin today, to address the challenges and help their organizations overcome.

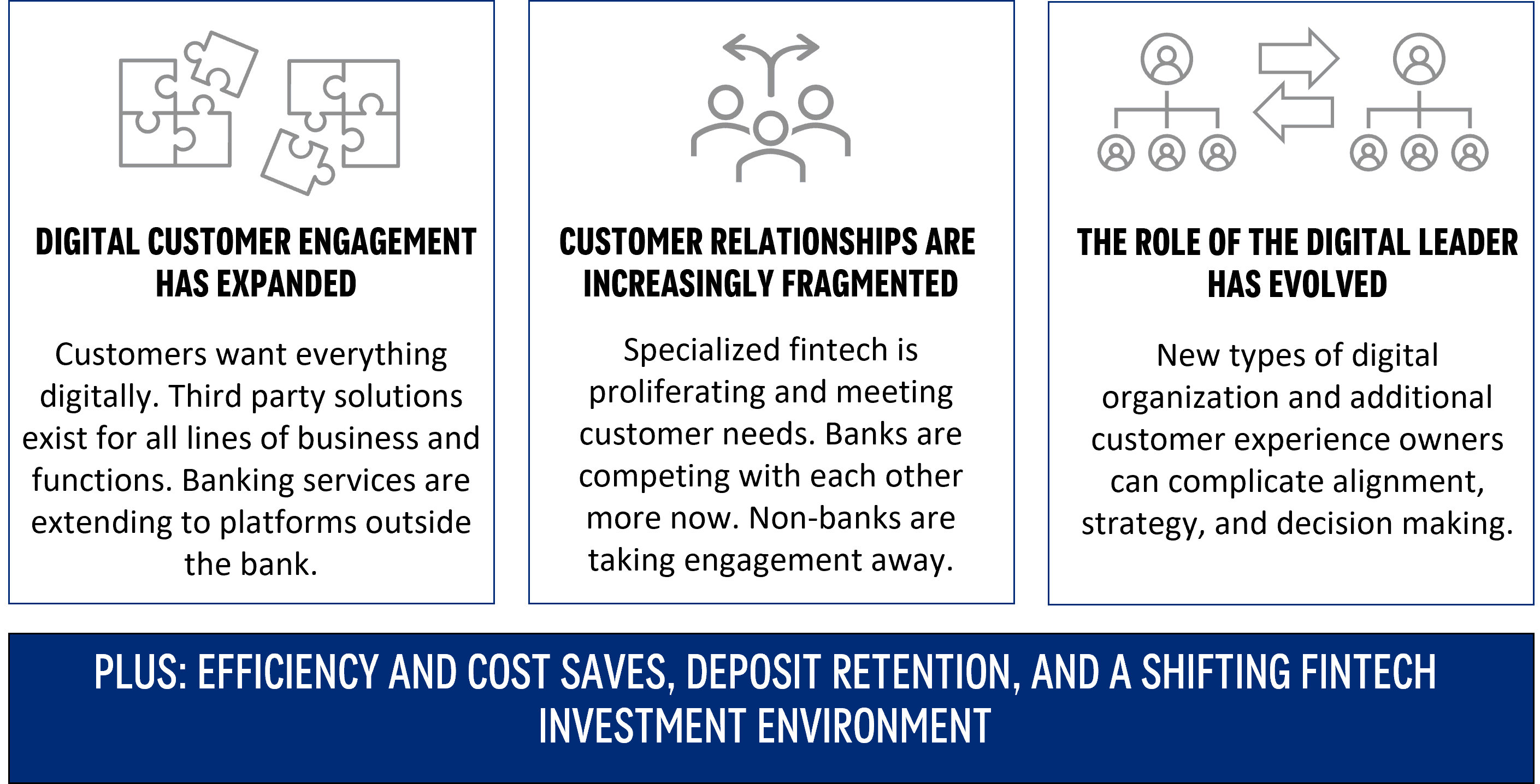

- Digital engagement has expanded into many new spaces. Once narrowly defined as online and mobile banking, digital customer engagement now includes multiple screen and information spaces where the bank delivers content, services, transactions, or data. Customers want everything digitally, and financial institutions can now pursue digital-first solutions in each line of business, leading to a divergence of customer experience.

- Customer relationships are increasingly fragmented. Banks’ traditional relationships with their customers are threatened. Fintechs are addressing the specialized needs of many different customer segments. Banks and non-banks are competing with each other for deposits and primary relationship status among consumers, who in turn credit great digital experiences as a primary driver of bank choice.

- The role of the digital leader has evolved. Digital leaders have widely varying levels of responsibility within retail banks. The digital organization can look quite different based on size or strategy of the organization. Additionally, there are more areas of digital customer experience to manage than ever, complicating alignment and collaboration.

Additionally, as high interest rates persist, and as the larger financial technology industry navigates growth concerns and market demand for greater efficiency, digital leaders face additional concerns, including:

- Demand from bank leadership for greater emphasis on efficiency and cost-saves.

- Increased emphasis on lowering the cost of deposits and on deposit retention.

- Destabilized or consolidated fintech partners.